Disagreements with the bank. Disagreement starts with the bank when there is a discrepancy in the bank statement when an accounting staff tries to do the bank reconciliation for the business. Every cashier tries to keep the cash as accurate as possible with daily up-to-date information. Many receipts and payments have […]

Tasks that need professional help Are you a work-at-home mom presiding over a sizable online business in nearly any industry? Then it can make sense to hire a bookkeeping service to take some of the financial burdens off top management, i.e., yourself. Adding an accounting service may be unaffordable for some […]

Self-assessment guide to small business. Any person who runs a business needs to pay taxes; you must submit a tax return to your tax office. When you start your business, you must register as self-employed and file the self-assessment tax return each year. It is by law, you have to file […]

Control accounts in Bookkeeping A control account is used to check the postings’ accuracy to a particular ledger account. Self-balancing includes a control account generally kept at the front or back of the ledger and used by the accounting staff on the total balances extracted from that ledger. In addition to […]

Capital and revenue expenditure When a business starting from scratch might have a small amount of cash in the bank account of the company. However, while trading, the business might need some assets to run it efficiently. Therefore, the industry spends money on fixed assets such as land and buildings, machinery, […]

What is the budget for a business? A budget is used to measure the financial strength of your business; the result could be in three ways. Surplus : Earned profits Deficit : Incurred losses Balanced : Income and expenses equal. What is the process of developing a budget? In most cases, […]

Twelve Tips for Interpreting Accounts of a Charity Twelve Tips for Interpreting Accounts of a Charity A charity is an organization that has to benefit the public. It can be a charity educating the underprivileged, removing poverty, or helping with health issues. Overall, it has to establish for the public benefit. […]

The types of journals in accounting The general journal does not form part of the double-entry system. It is used as a guide to help ledger accounting staff to do their postings. New start-ups and other small business owners will not be able to progress in their businesses if they do […]

Capital revenue expenditure in accounts .What is capital expenditure? The purchase of capital items like machinery, land & buildings, furniture, fixture, and motor vehicles to use in the business either in the long run or for one or two years. The expenses incurred in this way are called capital expenses. Capital […]

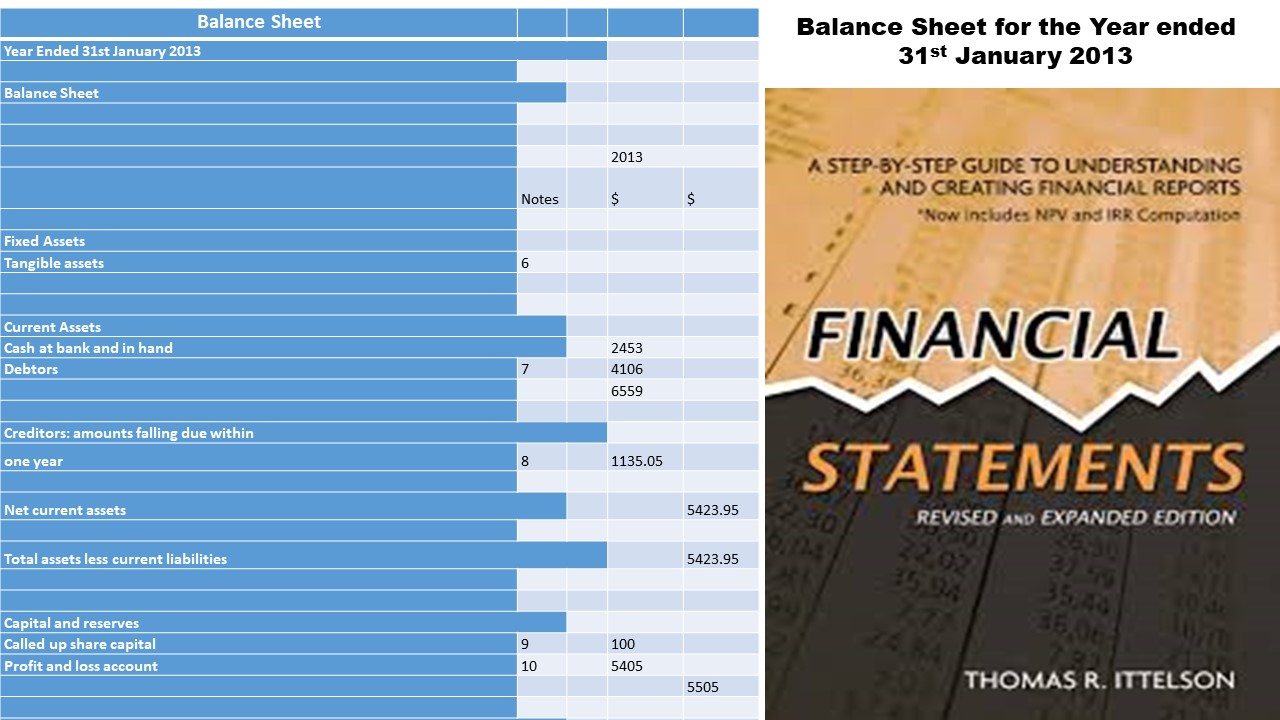

Final accounts of sole trader 2 What is a balance sheet? The balance sheet is not an account but a financial statement grouping and listing industrial properties, liabilities, current assets, assets, and capital on a specified date. It refers to the net worth or the financial position of the company. It […]