What is the meaning of journals in accounting?

Journals in accounting & bookkeeping mean recording financial transactions according to the date they happened. A journal said as the book of original entry. They post the transactions to the general ledger or the subordinate ledger after recording the Journal entries; that is why the Journal is a book of original entries. Journal entry is the first step acquired in accounting.

What is the difference between a general ledger and a general journal?

General Journal

It is a document where all company’s transactions are entered but not recorded in the specialty journals like purchase journals, sales journals, and cash journals.

Not possible to handle using a general journal to record entries more efficiently. The examples are,

- Sales invoices issued

- Purchase invoices receive

- Cheques written

Whereas the others when can enter computerized accounting systems. Manual accounting systems will use special journals to record daily transactions so that the general Journal will not have many entries.

In the general Journal, they do the entries as debit and credit with a brief description, then transfer to the public ledger to the appropriate accounts. In total, the debit side will be equal to the credit side.

Examples of using the general Journal are:

- Depreciation

- Bad debts

- Sale of an asset from the business

How to Prepare Journal Entries in Accounting

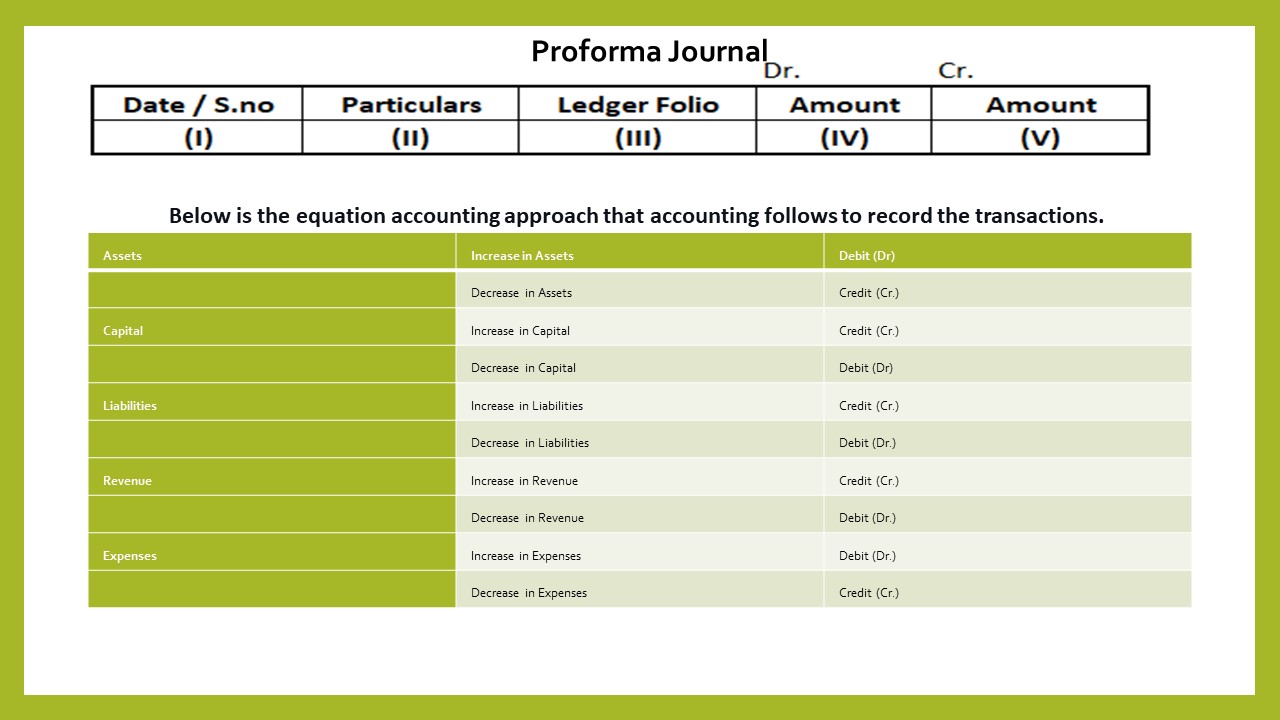

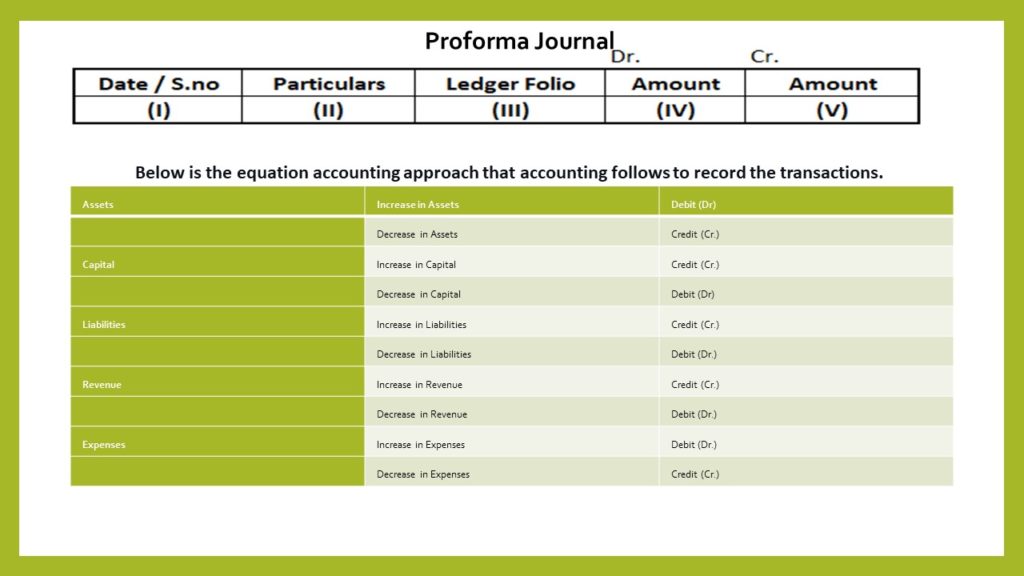

Proforma of a Journal

- Date/ S.No: The first column of the Journal is a date or serial number. It gets updated with the transaction record date or its serial number.

2. Particulars: The second column of the Journal is particulars, updated with the details of business transactions that related account types with descriptions.

3. Ledger Folio: The third column of the Journal is the Ledger Folio number where the journal entry goes into that.

4. Amount (Dr.): The fourth column of the Journal updates the transaction’s debited amount.

5. Amount (Cr.): The fifth column of the Journal updates the transaction’s credit amount.

How to prepare the journal entry?

The preparation of journal entries (Journalizing) is a straightforward method which is as follows –

1. First, read and understand the transaction clearly. Find out which account is to be debited and credited, and after this, you can enter a journal entry.

2. After entering the journal entry, write the summary description (narration) for debit and credit transactions.

Rules of Journalizing

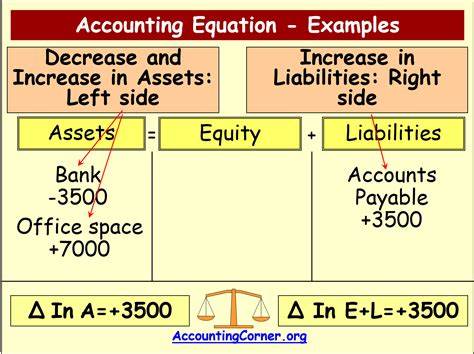

Below is the equation accounting approach that accounting follows to record the transactions.

| Assets | Increase in Assets | Debit (Dr) |

| Decrease in Assets | Credit (Cr.) | |

| Capital | Increase in Capital | Credit (Cr.) |

| Decrease in Capital | Debit (Dr) | |

| Liabilities | Increase in Liabilities | Credit (Cr.) |

| Decrease in Liabilities | Debit (Dr.) | |

| Revenue | Increase in Revenue | Credit (Cr.) |

| Decrease in Revenue | Debit (Dr.) | |

| Expenses | Increase in Expenses | Debit (Dr.) |

| Decrease in Expenses | Credit (Cr.) |

In other words, if I talk about the assets in a company, if you sell some of it, the total amount decreases, and the entry will be a credit.

If you buy some assets, the total entry amount is a debit.

The same rule applies to all transactions.

Examples of Journal Entries

- Here’s what a typical journal entry looks like:

Transaction: Pay an expense of $100.

Journal entry:

| Dr | Expense $100 |

| Cr | Bank $100 |

Let’s take a look at what this means.

First, Dr and Cr are abbreviations for Debit and Credit. We pay expenses, our expenses have increased, and money goes out of the bank, so the bank has decreased.

Debits and credits are shown in accounting to show the increase and decrease in accounting.

2. The journal entry will follow when you borrow money from the bank.

Borrowed $100,000 from the bank;

Dr Cash $100,000

Cr Loan payable $100,000

Dr cash means your cash in the bank increases, and the liability increases as a Cr loan is payable because you have to pay back the loan.

3. When you purchase equipment, the journal entry will be:

Dr Equipment $200.00

Cr Cash $200.00

Asset increases business because you bought the kit, and the cash in your bank has decreased as you pay for your purchase.

So, the multiple journal entries get listed in a T account; when you take the total, the debit and credits must be equal.

Therefore, when you make the journal entries, there must be a minimum of two-line items in a journal entry, though there is no upper limit to the number of line items that can include.

General Ledger

The general ledger prepared by the company is the set of the different master accounts in which the business transactions come from the related subsidiary ledgers. It contains the statements used to sort and store the company’s transactions.

When you organize the general ledger so that the accounts will appear in the following order:

- Balance sheet accounts: assets, liabilities, stockholders’ equity

- Income statement accounts: operating revenues, operating expenses, other revenues and gains, other expenses and losses

The balances and activity in the general ledger account help to prepare a company’s financial statements.