*What is financial planning, and what is its purpose?

Financial planning is managing one’s finances to achieve specific life goals, both in the short and long term. It involves assessing current economic status, setting goals, and making a roadmap to achieve those goals by adequately managing income, expenses, investments, and assets.

Financial planning is managing one’s finances to achieve specific life goals, both in the short and long term. It involves assessing current economic status, setting goals, and making a roadmap to achieve those goals by adequately managing income, expenses, investments, and assets.

The purpose of financial planning is multi-faceted:

Goal Setting:

Financial planning helps individuals or families identify their financial goals, whether buying a house, saving for retirement, funding education, or starting a business.

Budgeting and Cash Flow Management:

It helps create a budget that balances income and expenses, ensuring enough money to cover essential needs while saving and investing for the future.

Risk Management:

Financial planning involves assessing risks such as job loss, disability, illness, or unexpected expenses and creating strategies to mitigate these risks through insurance and emergency funds.

Investment Planning:

It involves analyzing investment options to grow wealth while considering risk tolerance, time horizon, and financial goals.

Tax Planning:

Financial planning includes strategies to minimize tax liabilities through tax-efficient investments, retirement accounts, and other tax-saving vehicles.

Financial planning includes strategies to minimize tax liabilities through tax-efficient investments, retirement accounts, and other tax-saving vehicles.

Retirement Planning:

It involves estimating future expenses and income needs during retirement, determining how much to save, and choosing appropriate retirement accounts and investments to achieve those goals.

Estate Planning:

Financial planning addresses the transfer of wealth to heirs and beneficiaries while minimizing taxes and legal complications.

Financial planning aims to help individuals and families make informed financial decisions, optimize resources to achieve their goals, and ultimately attain financial security and peace of mind.

How does it help a business?

Financial planning is crucial in helping businesses achieve their objectives and navigate various challenges. Here’s how it helps:

Setting Business Goals:

Just like in personal finance, financial planning for a business starts with setting clear, measurable goals. These could include revenue targets, profit margins, market share objectives, or expansion plans.

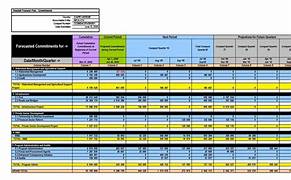

Financial planning involves creating budgets and forecasts that outline expected income and expenses over a particular period. This helps allocate resources effectively, identify potential cash flow issues, and make informed decisions about investments and expenditures.

Cash Flow Management:

Managing cash flow is essential for a business’s day-to-day operations. Financial planning helps monitor cash flow patterns, identify peak and slow periods, and ensure enough liquidity to cover expenses and seize opportunities.

Capital Allocation and Investment Decisions:

Financial planning assists in determining how to allocate capital efficiently, whether it’s investing in new equipment, expanding operations, hiring more staff, or pursuing strategic partnerships or acquisitions.

Risk Management:

Businesses face various risks, including market volatility, regulatory changes, competition, and operational challenges. Financial planning involves assessing these risks and implementing mitigation strategies, such as purchasing insurance, diversifying revenue streams, or establishing contingency plans.

Debt Management and Financing:

For many businesses, debt is necessary to finance growth or smooth out cash flow fluctuations. Financial planning helps evaluate financing options, manage debt levels, and ensure that debt obligations can be met without putting the business at risk.

Performance Monitoring and Decision Making:

Financial planning provides benchmarks for assessing business performance against targets and industry standards. It enables management to identify areas of strength and weakness, make data-driven decisions, and adjust strategies to stay on track toward achieving goals.

Businesses are expected to comply with various financial regulations and reporting standards. Financial planning helps ensure the company complies with these requirements, avoiding penalties or legal issues.

Financial planning is integral to a business’s success and sustainability. It provides a structured charter for managing resources, making strategic decisions, and navigating market uncertainties.