What is a budget, and why is it important for a business? *

What is a budget?

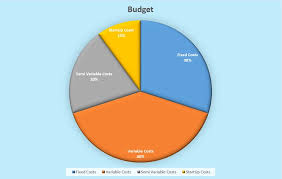

A budget helps to measure the financial strength of your business; the result could be in three ways.

- Surplus budget: Earned profits

- Deficit budget: Incurred losses

- Balanced budget: Income and expenses equal.

What is the process of developing a budget?

In most cases, a budget did depend on the approved balance from the previous year’s records. The process will benefit an organization in operation for some time, and the budget is done yearly. How will we create funding for a new venture? Assumptions are essential for projected sales, cost trends, and how the market for your industry. Specific factors affecting potential expenses need consideration and monitored. The budget is prepared on a trial basis, and starts to watch for a new venture every month.

Sales budget

It is the first budget to be prepared to know the cash flow position, As the preparation for subsequent allocations for costings depends on the cash flow. Depending on the organization, budgets get ready for different sections; for example, they need separate funding for materials, labor, and overheads for a manufacturing company. Then all the other budgets are amalgamated into the central budget, including cash flow forecasts and financial statements. In a big organization, the management complies budget, including all the departmental budgets, and then sends it for approval by the board of directors.

There are two types of budgets prepared for organizations; one is static, where all the costs remain the same regardless of the changes in sales, labor, and overheads. A fixed budget can help show the effectiveness of the operation of the funding for an organization.

The flexible budget is helpful for comparisons with the actuals and is used to make financial decisions, growth of the organization, and when starting another venture.

Reasons for budgeting

A business cannot open its doors each day without knowing what to expect and close its doors without knowing what happened. A company cannot run without proper preparation for the future and control its actual performance to meet its financial goals. Then the Business managers can plan for the profit, cash flows, and financial condition. These plans can be compared with the actual results and detect the reasons for the differences. It helps to exercise control when things are going off course. Planning financial performance and comparing that with the actual implementation is called budgeting. Any business cannot survive without budgeting, which leads to exercising control over the economic condition.

How is the budget prepared?

The preparation of financial statements is after the transactions have taken place. They do Budgets in advance for the expected deals and in conjunction with their economic strategy and goals—budgets built on realistic forecasts for the coming period. Do not do the Allocations from imaging the figures with wishful thinking. The business managers analyze the previous period’s financial statements and prepare the budget for the future. Then managers decide on concrete goals for the future depending on the comparisons with the actuals and revise the budget. Budgeting takes a fair amount of time for the manager.