What is the difference between bad & doubtful debts?

If you have bad debts in your business, you have lost them, and the buyer who never paid for your product or service will not pay in the future.

Doubtful debts are those you might not collect the payment for your sales, but there is a possibility you might get the price later. A situation for the probability of non-payment because of some disputes over the quality of the product or maybe delays in the delivery of the product. Besides, your particular customer met with sudden unexpected financial issues and was not in a position to make the payment within the deadline.

Therefore, if your customer’s economic situation changes, they will pay back their debts to you.

Consider these two when compiling your final accounts at the end of your financial year. If you have old debts and are unsure whether you will get the payment, it will be ideal for you to spend some time and enforce the credit-control techniques by reminding them to make the payment. If you do not get the price during the financial for which you are making the books declare it as bad debt.

Receiving cash before the end of your financial year will reduce your debtor’s account in your balance sheet.

How do you treat the bad debts in your books?

Transfer the bad debt from the debtor’s account as the debtor’s account is an asset, reducing the debtor’s account and setting up a wrong debt account.

Bad debt is an expense; therefore, it should add to income and expenditure accounts as an expense.

The balance sheet should take off from the accounts receivable account when you show it as a current asset in the balance sheet.

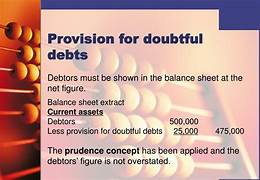

Doubtful debts are provisions for bad debts.

The procedure is to create a wrong debt provision account. Deduct the balance on this account from the debtor’s statements in the balance sheet, showing that your customers’ balance is collectible. You show the provision for bad debt in the profit and loss accounts as an expense in the business.

Currently, payments by cheque do not happen often. However, if the cheque is received and dishonored by the bank, it is transferred to the provision for bad debts account. Until the situation is more specific, the amount will be in the provision account if it changes removed from the requirement for bad debts, and the cash account will increase.

The double entry for bad debt is as follows

Dr – Bad debt account

Cr- Accounts receivable

Reduce the accounts receivable account, which is the current asset, account reducing that in the balance for a particular period.

Journal Entry for Bad Debt Provision

Debit – Bad debt

Credit -Bad debt provision

Lousy Debt Provision Bookkeeping Entries Explained

Debit

The provision for the bad debt is an expense for the business and a charge made to the income statements through the wrong debt expense account.

Credit

The amount the customer owes is still 500 and remains as a debit on the debtor’s control account. However, the credit above was placed on the wrong debt provision account in the balance sheet to reflect the uncertainty of overpayment.