Difference between Cashflow Statement and Cash Budget

The distinction between cash flow statement and cash budget is given below:

Difference # Cashflow Statement:

1. The cash flow statement shows the cash inflows and outflows relating to the firm’s operating, investing, and financing activities.

1. The cash flow statement shows the cash inflows and outflows relating to the firm’s operating, investing, and financing activities.

- The preparation of the cashflow statement is done as a postmortem exercise of the past events.

- The cash flow statement starts with the opening balance of cash and cash equivalents for the reporting period and ends with the closing balance of cash and cash equivalents at the end of the reporting period.

- The cash flow statement is used as an analysis tool to determine the likely cash flow. It discloses the increase or decrease in cash and cash equivalents and its reasons.

- The cash flow statement is prepared for a financial accounting period.

- The cash flow statement is prepared per the provisions of Accounting Standard-3 (Revised).

- The cash flow statement is prepared for the use of external agencies such as shareholders, financial institutions, investors, the government, etc.

Difference # Cash Budget:

- All expected cash receipts and estimated cash payments are incorporated into the cash budget to ascertain the excess of receipts over payments or any cash shortage for the period for which the cash budget is prepared.

- The cash budget is prepared for the forthcoming period as a planning exercise.

- The cash budget starts with the opening balance of cash in hand and at the bank at the beginning of the proposed period and ends with the closing balance of cash in hand and at the bank at the end of the period.

4. The surplus cash receipts may be planned for profitable investment in marketable securities. If any cash shortage is expected, management may take appropriate steps to resolve the situation.:

4. The surplus cash receipts may be planned for profitable investment in marketable securities. If any cash shortage is expected, management may take appropriate steps to resolve the situation.:

- The cash budget may be prepared for a month, quarter, half year, or annual.

- No specific format is prescribed for preparing a cash budget.

- A cash budget is prepared as a part of the planning exercise for the utility of internal management.

Comparison of the use of cash flow statement and the Cash Budget

The cash flow statement and the cash budget are crucial financial tools businesses use to manage their cash flow effectively. Still, they serve different purposes and are constructed in different ways. Here’s a breakdown of the key differences between the two:

- Purpose:

Cash Flow Statement:

The primary purpose of the cash flow statement is to provide a snapshot of a company’s cash inflows and outflows over a specific period, typically a month, quarter, or year. It helps stakeholders understand how cash is generated and used in business operations.

Cash Budget:

A cash budget, on the other hand, is a forward-looking financial plan that forecasts expected cash inflows and outflows for a future period, often monthly or quarterly. Its primary purpose is to help businesses anticipate their cash needs and plan accordingly to ensure they have enough liquidity to meet their obligations.

- Timeframe:

Cash Flow Statement:

It reflects actual cash transactions that occurred during a specific period.

Cash Budget: It forecasts cash inflows and outflows for a future period.

- Components:

Cash Flow Statement:

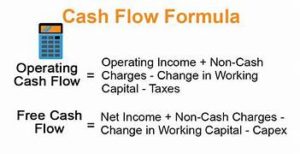

The cash flow statement typically consists of three main sections: operating activities, investing activities, and financing activities. It details cash inflows and outflows from these different areas of the business.

Cash Budget:

A cash budget typically includes estimated cash receipts and cash disbursements categorized by sources such as sales revenue, loans, investments, and expenses such as payroll, utilities, and purchases.

- Use:

Cash Flow Statement:

Investors, creditors, and management use it to assess a company’s liquidity, solvency, and overall financial health. It helps stakeholders understand how efficiently a company is managing its cash flows.

Cash Budget:

Management primarily uses it as a planning tool to anticipate cash needs, identify potential cash shortfalls or surpluses, and make informed decisions about capital expenditures, financing, and other financial activities.

- Flexibility:

Cash Flow Statement:

It provides a historical record of actual cash flows and cannot be altered after the period has ended.

It can be adjusted and revised as circumstances change, allowing businesses to adapt their plans in response to evolving market conditions or internal factors.

In summary, while the cash flow statement and budget are essential tools for managing cash flow, they serve different purposes. They are designed to provide various types of information. The cash flow statement reflects past cash transactions, while the budget forecasts future cash flows to assist with planning and decision-making.