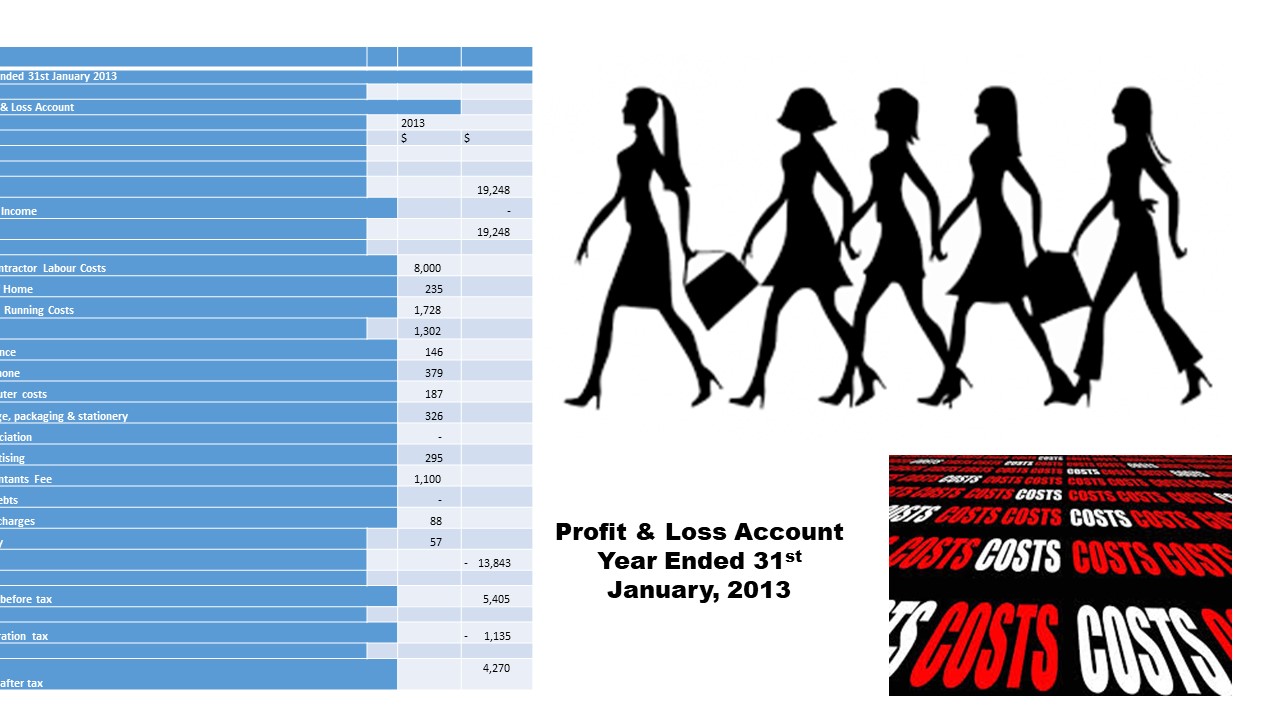

Final Accounts of a sole trader Part 1 Final reports include a profit and loss account and a balance sheet. Profit and loss show whether the company has achieved profit or loss. A financial statement summarises the costs, expenses, and revenues during a specified period. These records help the company increase […]

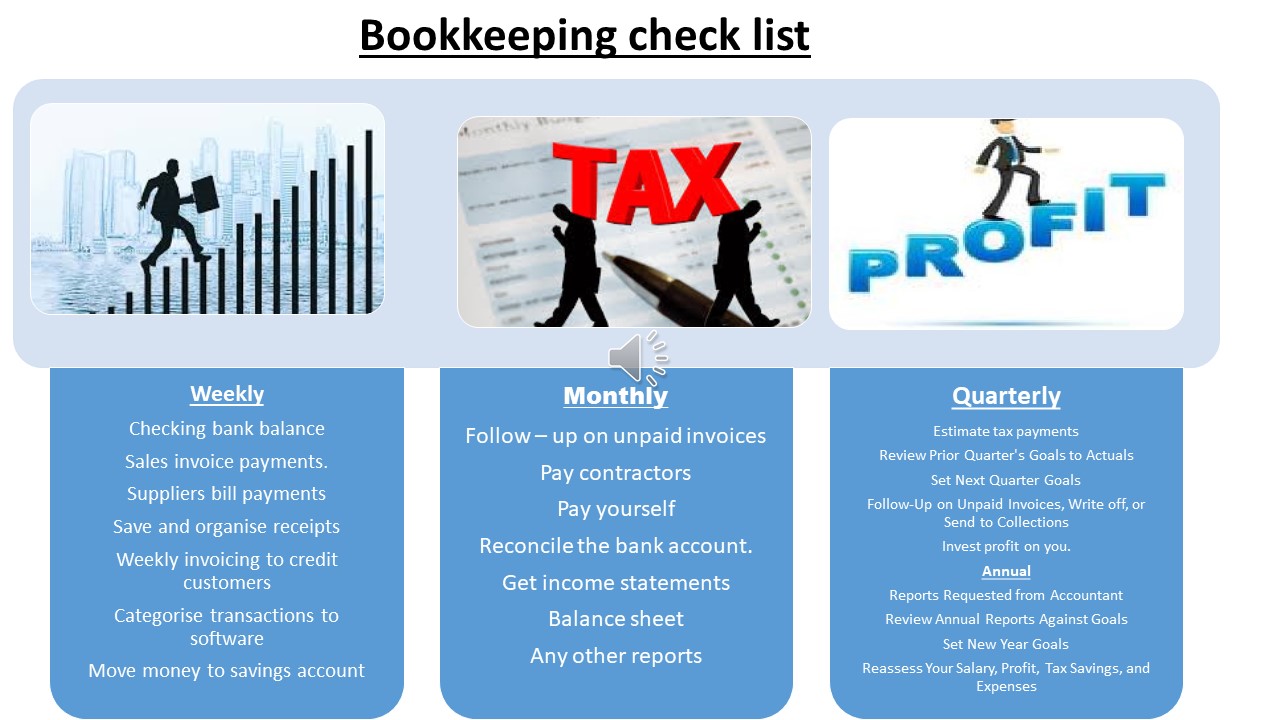

How to expand your records as your business grows? Analyzed cash book You might want to know some management information regarding your expenses as your business grows. As income increases, the costs also will increase. Therefore, it is vital to know about your expenditure. For example, you might want to know […]

Selecting suitable method for business accounting? When you are running your small business as a sole trader, the possibility of neglecting the accounting side of your business is possible. Primarily you are a start-up your concentration will be on setting up the company and make sure that you do right things […]