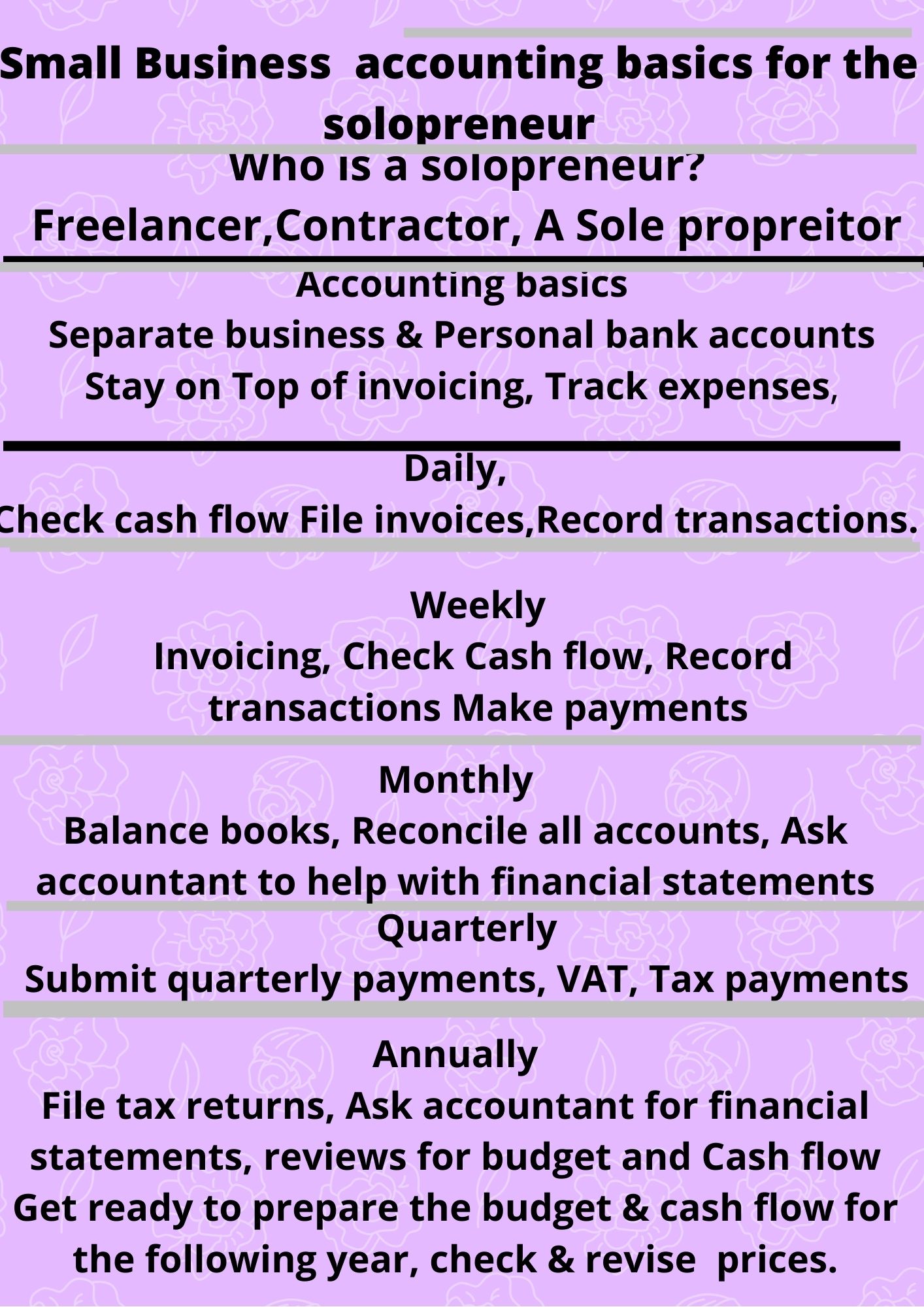

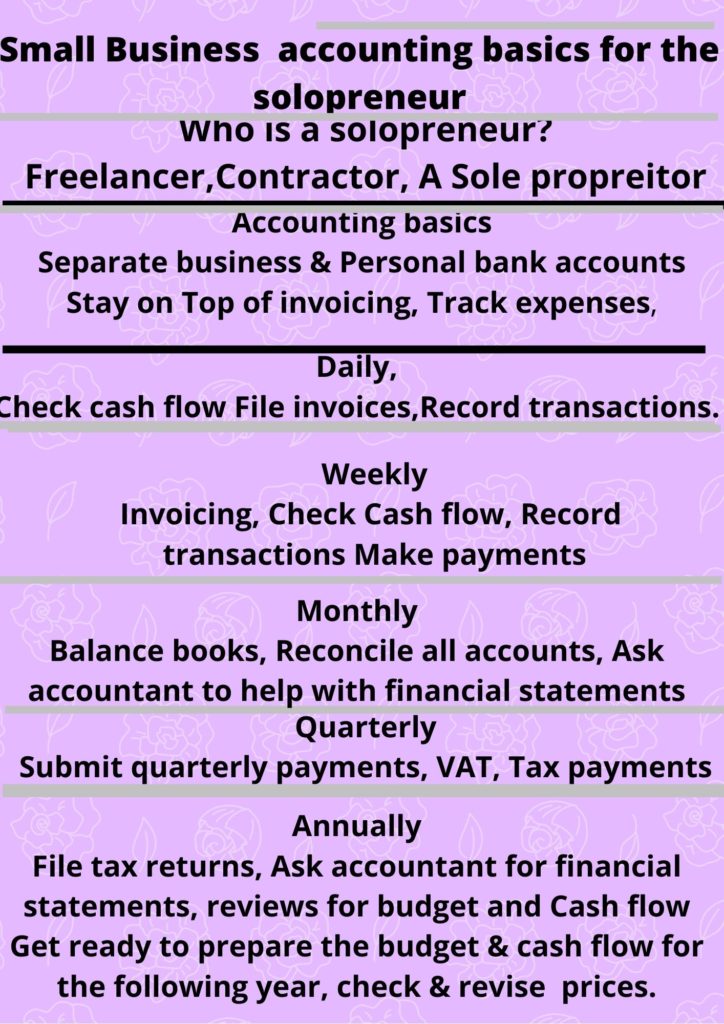

Small business accounting basics for solopreneurs.

If you look at this infographic image, it will help you to understand more.

Small business accounting basics for solopreneurs.

Your business activities consist of selling goods or services; simultaneously, you have to spend money on behalf of the business for purchases like raw materials, stationery, and equipment to run your business.

Every business transaction generates a financial transaction, all of which should record on books on an ongoing basis. Remember, this is fundamental management required to maintain your readers. Therefore, you must enter the records regularly, at least once a week. If you leave it for long, there will be so many possibilities that you put yourself in trouble.

The things that you might experience are the following issues in your business.

- Filing documents in the correct order

- You will not be aware even if you have lost some of them.

- You might forget to invoice your customer if you sell on credit.

- Eventually, your books will not balance also will not agree with the balance at the bank.

- You will face cash flow problems because you forget to collect the payments from your customer.

- You are neglecting your creditor’s bill and putting you in bad credit.

You cannot find the errors and pass the work on to your accountant, which will cost you more money.

What must information need to keep?

- Keeping invoices for purchases and sales in sequential order is a legal document demand for money.

- Maintain records of Wages details, payments made to whom, NI, and tax payments.

- Without bank statements, deposits & payment details, you cannot maintain the books.

- Have A complete record of VAT payments and claims.

- Small business accounting basics for solopreneurs.

The advantages of maintaining the system

To provide accurate information to assess whether you run the business at profit or loss. Whether the company is doing well, you will have enough cash to pay your bills on demand. Providing the correct information at the right time is a vital management tool. The business will survive with a sound management system.

Making VAT and tax payments becomes more comfortable, and setting the money to make these payments on time.

Do not forget figures say how many customers you had in a week because all those are recorded daily and given to you at a glance.