The daily tasks of accounting staff in a business The daily tasks of an accounting staff in a business A business should have a dedicated accounting staff to carry out these daily tasks. If not, the company will face difficulties. A person interested in accountancy, good with figures, interpersonal skills, and […]

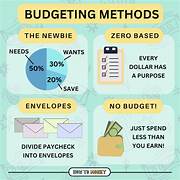

What is the piggybacking technique? The piggybacking technique helps you automate your spending so you always know how much money you can honestly spend. It’s easy to do: Step 1: Select your main categories of spending The aim is to balance your books so you’re not spending more than you earn. […]

How can I explain the power ratio? It is a financial metric that measures the proportion of a company’s debt to its equity. It is often used to assess a company’s financial risk and solvency. Here’s a simplified explanation of the leverage ratio: Definition: The leverage ratio is calculated by dividing […]

Why is Budget planning significant? For some individuals, planning is more critical than any time in recent memory. With family financial plans crushed due to the typical cost for most everyday items emergencies – all that from lease and home loan installments, food shopping, energy bills, and petroleum costs expanding – […]

How do you build business credit? What is business credit? Depending on your economic history, it is the same as building personal financial credit. Getting loans or credit cards or maintaining your supplier’s accounts for your business will show how you handle your finances. Connecting your credit report to your national […]

Accounting and planning strategies A few accounting growth strategies include: Expand through profits. Accelerating income. Building strategic business relationships. Diversifying business operations. Streamlining current production operations. These growth strategies depend on the size and strength of ongoing business operations. Strategic management accounting is about having an accounting system that checks, accommodates, supports, […]

The owners of small businesses and the freelancers become terrified of the tax liability when it comes to filing the tax return. When starting a small business, you must be aware of the tax liability and possible claims for your expenses. A proper accounting and filing system is essential to make […]

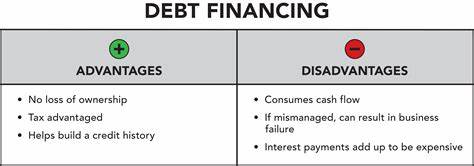

What is debt financing? Debt financing differs from equity financing, in which you raise funds by selling bonds, and buyers become your shareholders and must pay for their shares. Debt financing is when you raise money while running a business, which can be a short- or long-term loan. Bank loan Using […]

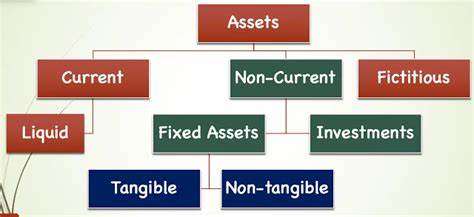

You will encounter These main concepts in the company’s daily accounting. Accounts period for a business: – Accounts payable- The money a company owes to suppliers, bills, and wages Accounts receivable – Money receivable from customers Accruals -These are the income & expenditure that is accounted for and not when cash […]