Cash basis accounting for the self-employed.

Cash basis accounting.

It is a way to work out your income & expenses for your self-assessment tax return if you are a sole trader. If you run a small business, cash basis accounting will be ideal rather than traditional accounting. You must declare when the money comes and goes out of your business. Therefore, you do not have to pay tax on the money you have not received in your accounting period at the end of the year. So, in this method, the transactions are recognized and recorded only when the payment is made or received.

Who is not entitled to have cash basis accounting?

It is not ideal if you have more complex transactions with high stock levels.

If you want a bank loan, they will ask for the traditional accounting showing the income, expenditure, outstanding debts, or what you owe before agreeing on the loan.

Your business might have incurred losses, and you might try to recover from the taxable income.

Who is eligible for cash basis accounting?

If you are a small business owner, it suits your business.

Your income is less than £150000 per year.

Partnerships can use this scheme if they are not a limited liability.

You must use a cash basis if you have multiple businesses, but your income must be within the limit.

Keeping records

You must legally maintain accounting records for all your business transactions if you are self-employed. So that you can use these records to file your tax return; therefore, you will need items like bank statements, invoices, receipts, and any other relevant documents regarding your business.

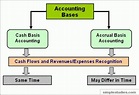

Cash Basis vs. Accruals Basis

They introduced a cash basis to make it easier for the self-employed to manage their accounts and work out their income and expenses for the year. Cash basis does not mean you only deal in cash – it is about when transactions are recognized and recorded.

Accrual Basis Accounting

It gives a more accurate picture of the income & expenditure of the business, and you can find out when the transaction took place rather than showing it in the bank.

We must consider any accrual adjustments before producing the final versions when preparing the accounts.

A customer might pay an invoice within 30 days of receipt, but the transaction will be in the accounts when the invoice is issued.

| Cash basis | Accrual basis |

| Income recorded when cash received | Record Income when the transaction takes place. |

| Expenses recorded when you spend cash | Post Payments when they do the bills. |

| Tax paid on money received | Taxes due on transactions take place |

| Used by freelancers and Self-employed | Use by small businesses and companies |

The main difference between the two schemes are all transactions will be included in the accrual system and the cash basis when the cash is received or spent.

When you make sales on an accrual basis and invoice the customer, the customer pays within 30 days so that the accounting entry will be in accounts receivable.

When you buy goods on credit, you enter into accounts payable, which are considered when preparing the profit and loss account.