Learning accounting to understand Tax Liability Meet the deadlines and avoid losing sleep over it Tax preparation is the information given out by an individual or an organization to a government body declaring all liabilities for taxation. Everyone wants to pay their taxes on time and be free of tax liability […]

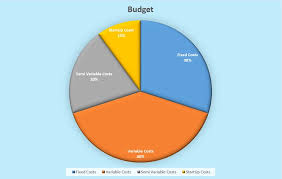

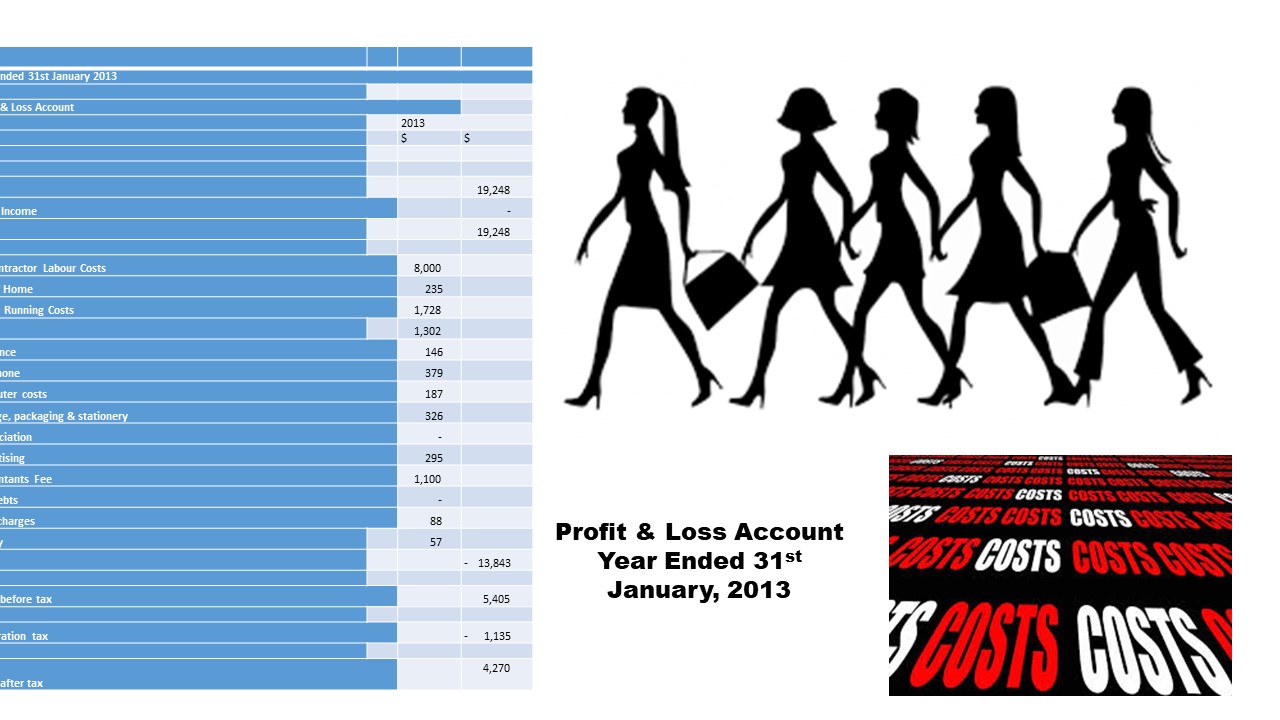

How to implement financial control in business? Profit & Loss forecast The profit and loss forecast is a projection of the sales and expenses that might occur during a specified period. If you say in a pure form, that is the forecast for the money you receive and your payout, which […]

What are the pros and cons of hiring a bookkeeper? Choosing by selecting a bookkeeper depends on the level of service that a company provides in its business. Whether you have an in-house bookkeeper, an outsourced bookkeeping company, or a freelance, all will have pros and cons. What are the pros […]

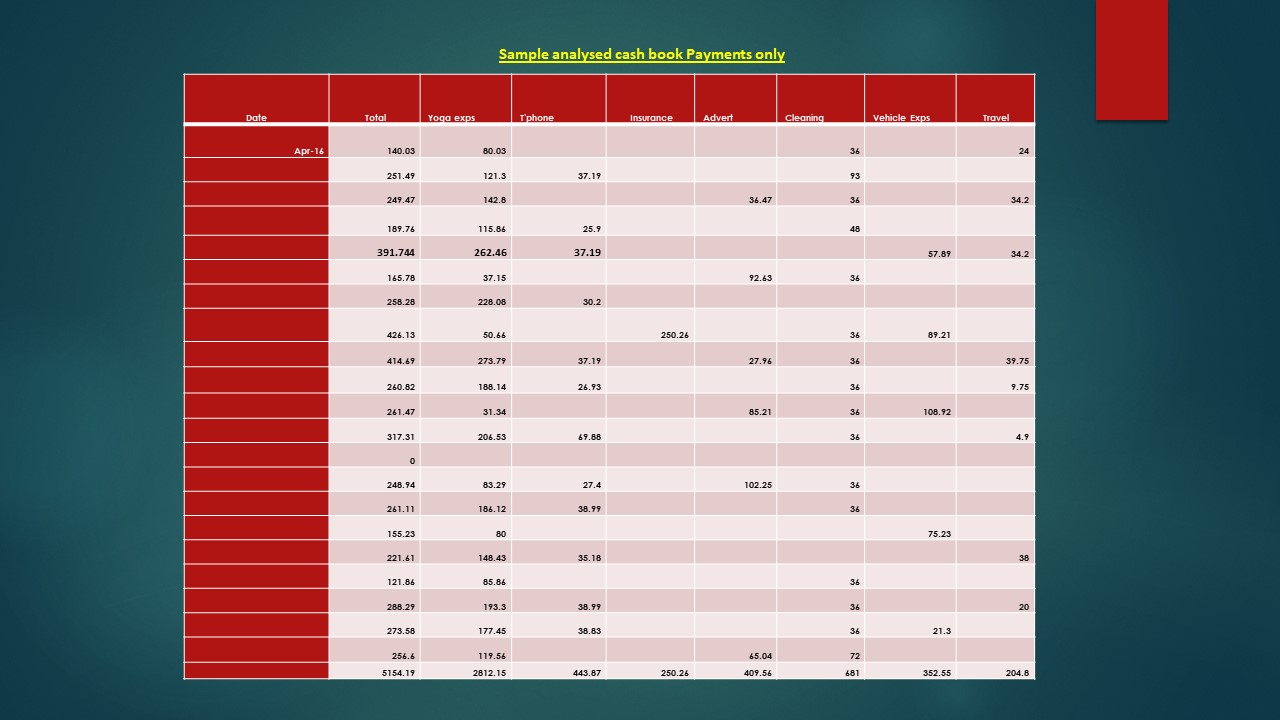

How to make a ledger account? The ledger is the official record of a company’s accounts, and sometimes we refer to the general ledger, purchase ledger, sales ledger, and cashbook. A catalog provides all accounting transaction entries and the balance for a specified period. At the end of the period, registers […]