What is debt financing?

Debt financing differs from equity financing, in which you raise funds by selling bonds, and buyers become your shareholders and must pay for their shares. Debt financing is when you raise money while running a business, which can be a short- or long-term loan.

- Bank loan

- Using family credit cards

- Government loans

- Personal loans

- Peer-to-peer loans

- Loans on homes

There are financial advisors to help you write off the debts, but the only thing you might get off the present situation from your current obligations. But ensure that if you want to be in business in the future, your credit history will not affect the possibility of getting loans for your business because, remember, if you have a bad credit history, it will affect you for a long.

There are financial advisors to help you write off the debts, but the only thing you might get off the present situation from your current obligations. But ensure that if you want to be in business in the future, your credit history will not affect the possibility of getting loans for your business because, remember, if you have a bad credit history, it will affect you for a long.

When businesses want to grow or seek additional working capital, they use debt financing.

There are some types of debt financing.

- Secured loans

- Unsecured loan

- Loans of equipment or assets

But paid back according to the agreement with the interest; otherwise, the business will go into bad credit.

Video

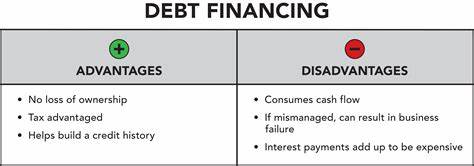

The main advantage of debt financing is the lender does not take an equity position in your business.

Further, the interest you pay will be deductible from the payments to the tax office. Then, in the case of long-term financing, you can extend the repayment period for much longer.

The advantage that helps the accounting system is setting up the budget; easy to add to it.

- Build the better business credit

- Provides control for owners’ equity

Long-term debt financing

If the business wants to purchase equipment, machinery, and buildings, the lender will want the loan to have security, generally by support. This long-term will typically have a 3 to seven-year repayment period and will be available if Small Business Administration approves up to 10 years. Also, it will have fixed interest rates up to the payment period.

If the business wants to purchase equipment, machinery, and buildings, the lender will want the loan to have security, generally by support. This long-term will typically have a 3 to seven-year repayment period and will be available if Small Business Administration approves up to 10 years. Also, it will have fixed interest rates up to the payment period.

When the company sets a budget, it becomes easier to add as it becomes the regular monthly payment.

ort-term debt financing

It usually applies to using day-to-day expenses and keeping up with the working capital shortfalls such as employee wages, inventory purchases, and other daily payments. The repayment usually takes a year.

Start-up business typically faces financial issues, and the help gets in the same way as topping the working capital. Because of these issues, most companies use a credit card to fulfill this shortfall, and if they miss payments back to the credit card company, they will fall into many troubles.

There could be disadvantages to debt financing, which are as follows.

There could be disadvantages to debt financing, which are as follows.

If the business wants to extend the repayment period, the lender might ask for security and might from the assets that put you in danger as you might lose everything if anything goes wrong in your business.

Most small businesses need help with financial problems within their first three years as they are new to running a business. Also, they face these issues due to the mismanagement of the finances. Therefore, the debt financing system is an excellent help for those businesses to survive.

.