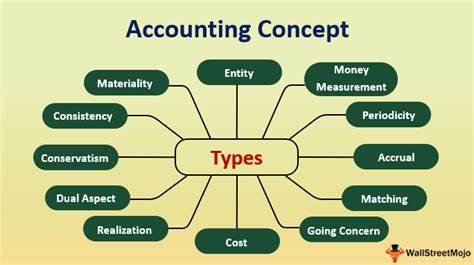

You will encounter These main concepts in the company’s daily accounting.

Accounts period for a business: –

Accounts payable- The money a company owes to suppliers, bills, and wages

Accounts receivable – Money receivable from customers

Accruals -These are the income & expenditure that is accounted for and not when cash gets paid.

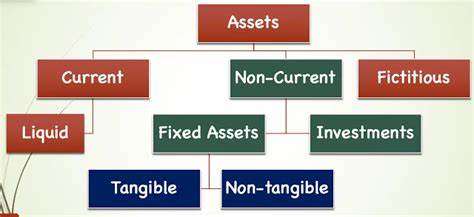

Assets- Everything a company has, like machinery, building, Furniture, cash, and accounts receivable. Assets can be current assets and non-current assets.

Balance sheet – The financial statement represents the snapshot of the company’s financial position at a particular date.

Capital-It represents the money invested in a business by the sole trader or a partner. If in a limited company, it is the value of shares the shareholders buy.

Cost of goods sold- All money spent to purchase or make the products to sell to its customers.

Depreciation is an accounting method used to assess the aging of assets; say, how do you evaluate the price of a car every year? The value goes down depending on the mileage that you use the vehicle.

Equity: All the money invested in the business by the owner shows in the capital account, and a limited company owner’s equity indicates in the shares of stock.

Expenditure: The expenses incurred by the business should not include if spent on other things.

General Ledger: All the company accounts are summarized.

Income is the income generated by selling products or services and from other sources like bank interest; income from the investment is other income.

Income statement: Represents the statement of financial activity, whether monthly, quarterly, or yearly. The calculation is total income less the cost of goods sold, and the expenses incurred in running the business become the net profit.

Interest: It is the money the company needs to pay for the cash borrowed for the business development, to buy the necessary machinery for the capital, and the interest on the amount the company received for the purchase.

Inventory: The account maintains track of all the products

sold to the customers.

Journals: Bookkeepers keep records of daily transactions of the company. Each of the most active accounts, such as accounts payable, accounts receivables, and cash, has its journals.

Liability: All the company owes is bonds, loans, and unpaid bills. There are two types of penalties: current and non-current liabilities are payable within one year, and non-current liabilities are payable after more than one year. Examples of non-current liabilities are bank loans and mortgages.

Payrolls: Wages paid to the employees; it usually is the Bookkeeper’s responsibility and needs to make the payments to the tax department too.

Retained Earnings: Reinvest all the company profits in the company rather than pay out to the owners. The sole trader’s money paid out is in the drawings account, and the limited company is in the dividends account.

Revenue: All monies earned by the sales of its products or services, and some companies get revues from other sources like interest received and by selling assets that are not good enough for the company.

Trial Balance: The Bookkeeper usually records daily accounts, ensures that the books are balanced, and gets ready to close the charges for the end of the financial year so that the accountant will do the rest of the work.

The above information will help a newbie prepare to start a business, and it is always advisable to learn the basic accounting concepts to save your business from trouble as an entrepreneur.