What are the features of the accounting discipline?

You know an organization’s economic health by disciplining, identifying, and measuring using accounting. The discipline of accounts is easily understandable when you have a solid understanding of other organized disciplines.

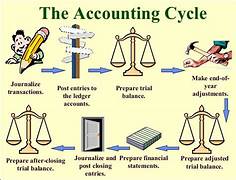

The definition of accounting is the record keeping of all the financial transactions of the business. To know the industry’s productivity, transactions that occur throughout the day need proper recording without missing anything. We have to accept that accounting is an integral part of the business. The process is collecting, recording, studying, and reporting the financial transactions in an organization.

To find out the organization’s financial health, they use the summary of the transactions recorded. Besides, it helps to find the financial position, operations in the company, market share, and cash flows.

The analysis of these statements indicates the organization’s financial health; the accounts department carries out these functions in a big organization. A bookkeeper does this in a small business, and an accountant will do the analytical part of the financial work.

The authorities and the responsible person get all these records and the analytical information of management and cost accounting to decide the market situation and whether further investment needs to grow the business or even sustain the growth.

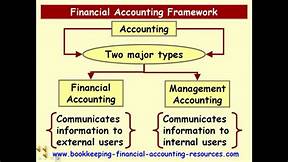

They use these principles to prepare financial statements, which the public and the shareholders will see.

These standards are also a part of the outstanding amount and balance sheet rectification and depend on the double-entry method of the accounting system.

Characteristics of Accounting Information System

Accounting aims to provide information about the financial position, performance, and changes in the financial part of an enterprise that is useful to a wide range of users in making economic decisions. The accounting information must possess reliability, relevance,

Understandability and comparability to validate the system.

Dependability: Information needs reliability if it is free from error and bias and faithfully represents what it seeks to mean. Information when given for a purpose the users should believe and depend upon by the users for a given purpose. To ensure that information is reliable, it must be verifiable, neutral, and faithful in representing the economic condition.

Significance: Information said to be relevant if it influences the decisions. The relevant information must be available in time, must help in prediction, and help in feedback.

Understandability: The accounting information must possess the quality of economic significance to the user, i.e., to understand the content and relevance of financial statements and reports. The qualities that distinguish between good and poor communication in a message are fundamental to the understandability of the message. A message needs touch when interpreted by the receiver of the message in the same sense the sender has sent it.

Comparability: The quality of information enables users to identify changes in economic phenomena over a period between two or more entities. Accounting reports should be comparable across the firms to identify similarities and differences. Accounting reports must belong to a period, use a common unit of measurement, and use a standard reporting format for comparison.