Final accounts of sole trader 2

What is a balance sheet?

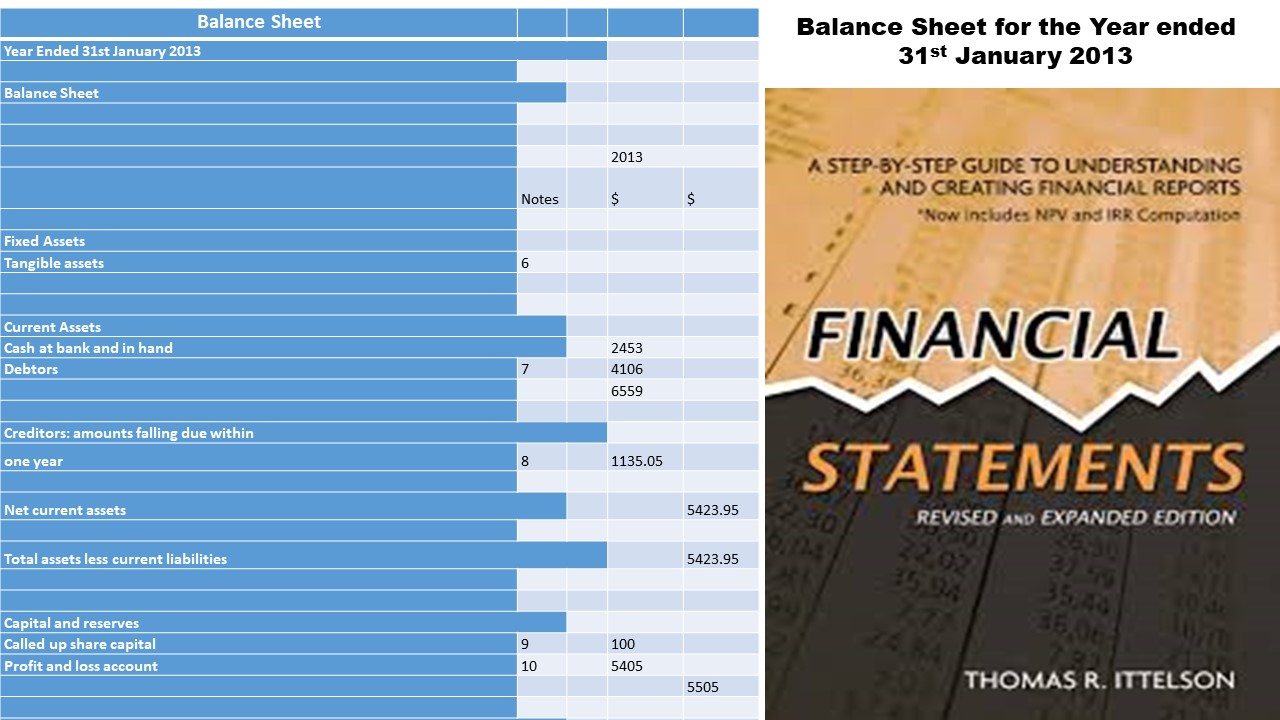

The balance sheet is not an account but a financial statement grouping and listing industrial properties, liabilities, current assets, assets, and capital on a specified date. It refers to the net worth or the financial position of the company. It is explained using the equation Assets+ Liabilities + Equity. It is crucial to prepare your financial statement as it shows the people who are interested in business the financial position of your business. Further, when needing financial help, a lender will want to see your financial report. A balance sheet is one of the three reports, profit and loss account, cash flow, and the balance sheet.

| Balance sheet as at 31st August | |||

| Fixed assets | £ | £ | £ |

| Premises at cost | 10000 | ||

| Machinery | 3000 | ||

| Furniture & Fittings | 350 | ||

| Motor vehicle | 2650 | ||

| 16000 | |||

| Current Assets | |||

| Closing stock | 2645 | ||

| Debtors | 1800 | ||

| Bank | 690 | ||

| Cash | 125 | ||

| 5260 | |||

| Current Liabilities | |||

| Creditors | 1280 | ||

| Expense creditors | 20 | 1300 | |

| Net current assets | 3960 | ||

| Net Assets | 19960 | ||

| Financed by: | |||

| Balance on 1st September | 19000 | ||

| Net profit | 6528 | ||

| 25528 | |||

| Less drawings | -5568 | ||

| 19960 |

Fixed assets

It is usually listed and added first in the balance sheet showing the different types of fixed assets that the company has in the order of permanence. If the business owns the premises, it will be the first value-added to the balance sheet, as it is a long-term asset compared to other investments.

In the case of machinery and vehicles, the value goes down fast because of heavy wear and tear — the reduction in costs of these assets is called depreciation.

Final accounts of sole trader 2

Current Assets

As you see in the balance sheet. The least liquid item is entered first, and the usable item comes as the last one entered under existing assets. These assets change during trading and can sell stocks for cash, and cash increases, then the unpaid customers increase. Then the value of debtors also increases. When more money comes in, more shares are bought for cash or on credit, creating value for trade creditors. Therefore, the changes in trading go on as far as the business in existence.

Bank and cash are called liquid assets, and the little money is paid into the central bank account. The total current assets here are $5260, and the total current liabilities of $1300 are deducted to show the net existing assets. The $1300 we owe needs to be paid within the next twelve months.

If there are long-term liabilities will be put below the current liabilities, but in this example, no long-term commitments that are bank loans and other debts. So, the balance in the existing assets is added to the fixed assets that will be the business’s net assets.

Final accounts of sole trader 2

The last element in the balance sheet is to show how these are financed. The first one is the capital, which is owned by the sole trader and brought to this balance sheet from last year’s accounts — then added to the profit of £6528 made in this business. Then the owner took some money for personal use called drawings that amount to $ 5568, which must be deducted from the total. Now you can see the balance sheet balances at the end.

Final accounts of sole trader 2

The last element in the balance sheet is to show how these are financed. The first one is the capital, which is owned by the sole trader and brought to this balance sheet from last year’s accounts — then added to the profit of £6528 made in this business. Then the owner has taken some money for personal use called drawings, which amounts to $ 5568 that must be deducted from the total. Now you can see the balance sheet balances at the end.