How do you make a chart of accounts?

What is a Chart of Accounts?

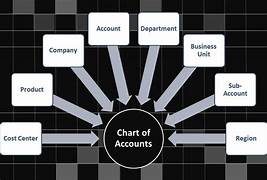

The purpose of the chart of accounts is to show the list of all the financial reports in the balance sheet, including cash flow and income statement. It gives a way to classify all financial transactions a company conducts in a particular economic time.

Companies always use the chart of accounts to arrange their records by providing a complete list of all the reports in the business’s general ledger. The chart helps prepare information for calculating the company’s financial performance at any given time.

To make a chart of accounts, you must classify account classifications appropriate to your business and then assign a four-digit numbering system to the funds you make. Even though creating a chart of accounts can be time-consuming, it’s an important tool to make the financial health of your business transparent.

What is the use of a Chart of Accounts?

A business’s chart of accounts is a simple list of its financial statements that become a blueprint or roadmap reflecting its financial architecture.

Every account in the chart of accounts relates to the two important financial statements, i.e., the balance sheet and income statement. Such charges are required when creating a balance sheet for the business. Balance sheet accounts comprise the following:

- Asset accounts

The company’s general ledger becomes helpful in preparing a chart of accounts that could easily show the company’s financial performance. Besides, it helps the company to design the end-of-year reporting.

It lists all the financial accounts included in a business’s financial statements.

All the information, like a brief description, the name of the account in the list, and the number code for each account, will go to the chart of accounts.

It starts with the balance accounts and the accounts in the profit and loss account.

The accounts in the balance sheet are fixed assets, current assets, current liability, and shareholders’ equity. The charges get broken down into various subcategories.

The income statement will have revenue and expenses, and these accounts will show the various subcategories.

How to make the Chart of Accounts

When making a chart of accounts, typically, the charges listed will depend on the nature of the business.

A numbering system is used in the chart of accounts to identify the charges quickly.

The numbering system makes it easy to record a transaction.

Small companies use three-digit numbers, and large companies use four-digit numbers.

Groups of numbers are given to each of the five main categories, while blank numbers are for new accounts added later. Besides, the numbering must be consistent to help the management create the information about the company from one period after the next.

Example: An extensive business numbering system

Categories on the Chart of Accounts

Every account on the chart of accounts belongs to two main categories: Balance sheet and income statement.

Accounts in the Balance sheet

What are the charges required to create a balance sheet?

- Fixed asset and current asset accounts

The asset will have two types of investments they are fixed assets like land and buildings, Machinery, and more.

The current assets are cash at the bank and hand and accounts receivable.

You can number every asset account in an arrangement like 1000, 1020, 1040, 1060, etc.

- Liability accounts

It is an account with a list of categories of debts the company owes to the others. Liability accounts for many expenses like salaries, invoices, and interest payables.

For the liability account, the numbering can start with 2000. It becomes easy to follow in the different accounting periods.

3.Owner’s equity accounts

3.Owner’s equity accounts

Equity represents the value left in the business after taking the liabilities from the assets. The company’s shareholders can value the company from the owner’s equity. In a small company, obtained earnings will be in the owner’s equity account, which includes other companies, such as common stock and preferred stock.

The numbering system will start from 3000 and go up to 3999.

Income statement accounts

The income statement accounts’ elements include the revenue and expense accounts.

- Revenue accounts

Revenue accounts capture and record the income.

That the business acquires from selling its products or services only includes revenues related to the exact operation of the company. It excludes income that has no connection to the business’s primary activities.

Some subcategories under the revenue account are the sales discounts account, sales returns account, interest income account, etc. Each revenue gets the number starting from 4000.

- 2. Expense accounts

It is the last category in the chart of accounts. It includes a list of all the funds used to capture the money spent in making income for the business. The expenses can be tied back to products or revenue-generating activities of the company.

Each of the expense accounts can get numbers starting from 5000.

So, prepare this Chart of accounts for different categories

- Asset

- Liability

- Equity

- Revenue

- Expense accounts.

The Asset has all these accounts

- Cash

- Accounts receivable – The payments receivable from your debtors.

- Inventory – The stocks you use in your business.

- Fixed assets – Machinery, Furniture, and more

- Other assets

Liability has all these accounts.

Liability has all these accounts.

- Accounts payable – Cash payable to your suppliers

- Salaries to employees

- Administration expenses.

- Other expenses

It would help if you needed a workbook, so create your chart of accounts on the first sheet of your workbook.