How to fix an incorrect trial balance?

How to fix an incorrect trial balance?

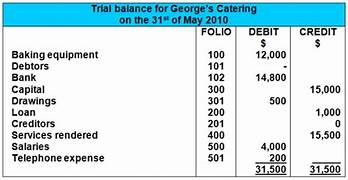

The trial balance is a statement of debit and credits of all the ledger accounts, and if the debits and the credits do not balance indicates an error. A trial balance is prepared periodically at the end of each reporting period to make the financial statements.

What is a trial balance?

The trial balance is not an account; it is not part of the double entry, a list of all the debts and credits from the ledger accounts. It is just prepared to check the accuracy of the postings and used by the accountant in preparing the profit and loss account and the business’s balance sheet. The figures in the trial balance are the final total of all the ledger accounts, and it doesn’t include any other entries in the ledger accounts. If no mistakes are made in the original postings in the ledger accounts, there shouldn’t be an issue with the debits and credits in the trial balance to balance. If the totals in the trial balance don’t agree, you need to check that in a couple of ways.

Finance statements depend on the trial balance.

When the time comes by the end of the month to prepare the financial statements, start with a trial balance. It is impossible to produce accurate financial statements if there are errors in the trial balance. Therefore the errors need to be fixed before moving forward, and practice is required to correct the mistakes. An error in the trial balance indicates some errors in the ledger entries.

The following are the reasons for the mistake.

Review the current account balance and check each account in the ledger. Then check each debit and credit balance in the trial balance report is correct. Sometimes you can put the debit balance on the credit side of the trial balance column and vice versa. If you identify anything like that on the wrong side of the column, adjust it. When that is done, your trial balance should balance.

How to fix an incorrect trial balance?

The standard error could be when writing the number you might write, for example, if the name 567 is entered as 765. This mistake could be easily detected and changed to adjust the trial balance to balance it.

Sometimes you could have missed some of the ledger accounts when compiling the trial balance.

How to correct these mistakes?

First, start checking the trial balance by matching the correct totals of each column. Then check the accounts totals and add up the debt and the credit side of the ledger accounts. Then ensure that accurate balances in the ledger accounts are transferred to the trial balance.

Then inspect each account and identify the journal entries to ensure mistakes are not made. If a journal entry is posted incorrectly, you could reverse those entries to make the corrections.

Why do we do accounts manually, even with all these advancements?

Small business start-ups today find it even to implement a proper accounting system for their small business. So, do you think they use accounting packages or hire an accounting professional to do their accounts? Therefore they need to learn accounting basics to file their statements with the tax office. I am writing these few tips with the hope that they might help the small business owners. The manual system might look cheaper for the owner, but considering the time you spend is not cheap. Remember, time is money.

Implement Computerised accounting.

Almost all businesses have computerized their accounts to make things easy for them. Even though computerization is fast and quicker in producing reports cannot say it is 100% perfect. But it can quickly detect your errors if you make a mistake in a journal that will alert you about the imbalance. Then another issue is if you debit cash sales for 650 and credit sales for 750, the accounting software will notice that. Therefore accounting software helps you to identify, correct, and balance the report quicker, is helpful for your production of the trial balance, and is not complicated at all with the use of accounting software.