Why do small businesses need an accounting system?

A robust accounting system helps the business build a strong foundation for your business.

You might have a few staff, but you must decide who will do your business’s accounting side. Then you have to choose between a cash basis or an accrual system. Then, a business owner should be able to decide whether to use suitable accounting software.

Most business owners want a management control system, which helps them have a pulse on the business when they use specific tools and management plans.

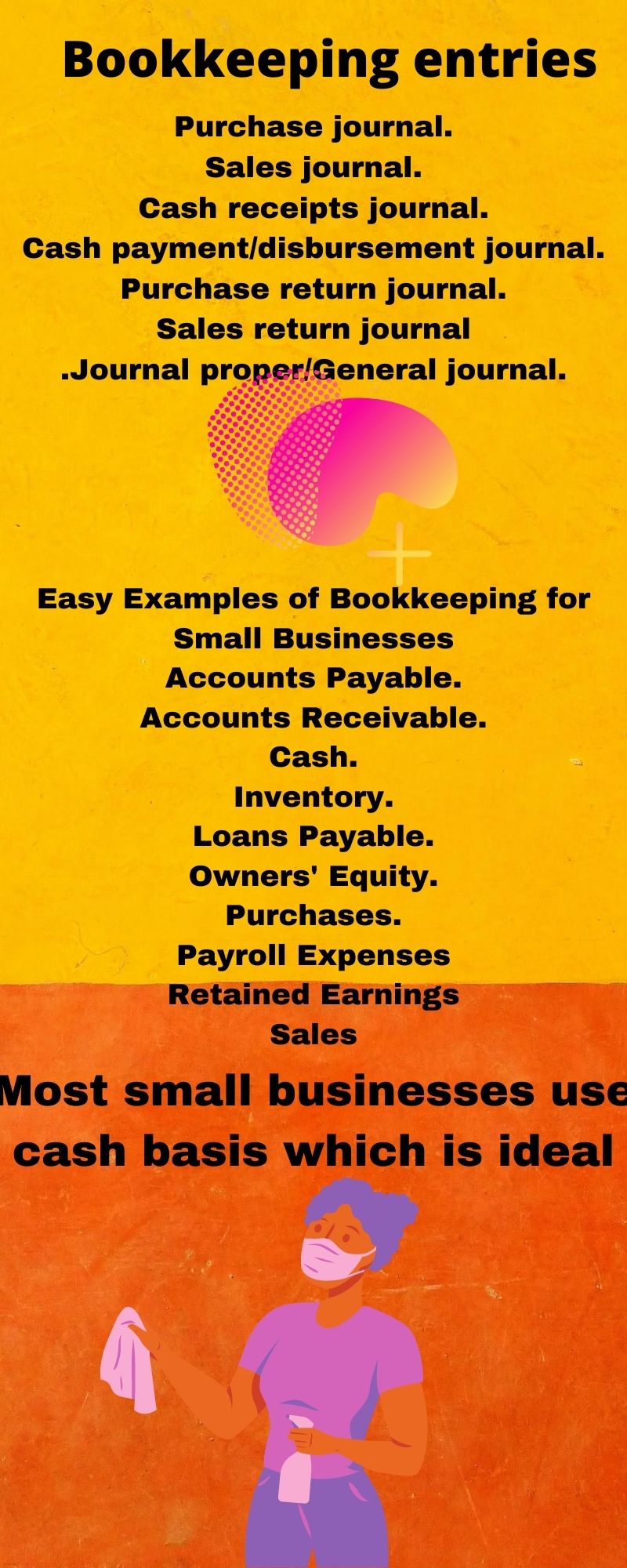

It is essential to have accurate business information to make correct decisions; therefore, they need to implement them. As said here, you need to set up everything to carry out the essential bookkeeping functions for a small business, which is shown in this infographics image below.

I will give some tips that take you t the correct path for implementing various systems.

Keeps all your documents safe, such as invoices, bills, bank statements, and legal documents, so you can easily access them when needed. Also, have a tax advisor so that they will advise you about the necessity of safekeeping records to become more comfortable to use for the computation of tax liability.

File all your documents and keep them separately, either physically or virtually. It is essential to separate and categorize the records before putting them away is necessary because you might spend a lot of time looking for them.

Decide who will do the accounting work, or even you might want to do that, but remember accuracy is the most important to save from disaster. You can use the other options as well as outsourcing or hiring someone to do your work.

Choose your accounting method. Most small businesses use cash accounting methods where you record your income when cash is received or may pay using credit cards. In the same way, you register your expenses when paid out.

A separate bank account is essential, as you do not want to mix up your personal and business expenses using one account. If a tax inspector comes in, you might incur a loss, as they get confused with your expenditure pattern.

Why do small businesses need an accounting system?

Do not forget to reconcile all your account’s income, purchases, inventory, and the ban account. If not, you can find the errors in your accounting work.

Think about having accounting software that gives all the necessary information if you need it at the end of each month provided to input all the data correctly. It becomes so helpful to make strategic decisions if you are looking for ways to grow or invest in another business.

Most accounting software that is not expensive could be quickly done with some training to handle the accounting package.