Tips for managing the accounts and business. After many years of working in the accounting sector and my failed business experience, I want to insist that small business owners prepare themselves to implement systems in their businesses to avoid disappointments from the start. Maintain good bookkeeping from the first day of […]

How do accountants help to grow businesses? Any wise business owner knows the value of an accountant’s help. You, a business owner with the right partnership with an accountant, will get the best advice and significant support at tough times and become an asset to your business’s growth. A management accountant […]

Charities Fund accounting for reports. The main difference between maintaining accounts in business and charity is accounting for funding. Fund accounting for charities splits the income and expenditure charges into several categories according to the purpose of funding received from the funders. Let me look at the different types of funding […]

Can founders treat charities like a business? Some founders of charities do not realize the charity’s regulations, and they start to think about the profit they can make from that charity. That results in mismanagement of the charity and ends up making profits. I have seen the founders of a charity […]

What is the difference between charity and business accounting? I have worked in the accounting sector for charities for the last thirty-five years, so I know the complexity of preparing financial statements for charities. What is the difference between charity and business accounting? When preparing company accounts, take income and expenditure […]

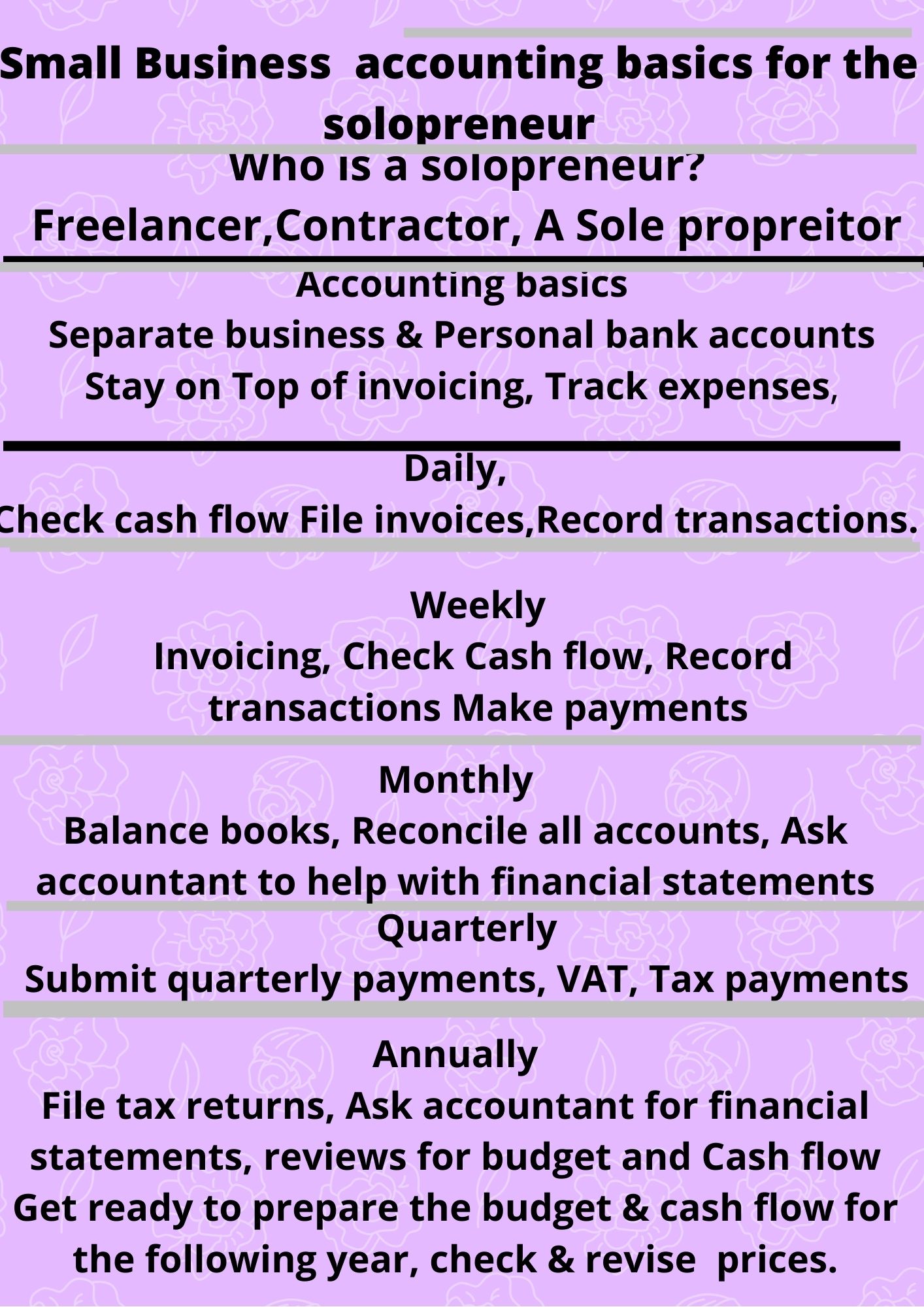

Small business accounting basics for solopreneurs. If you look at this infographic image, it will help you to understand more. Small business accounting basics for solopreneurs. Your business activities consist of selling goods or services; simultaneously, you have to spend money on behalf of the business for purchases like raw materials, […]

How to be financially independent? To be financially independent, you must learn money management as a start-up habit. When they are young, some children get pocket money from their parents, and parents teach them how to save and spend it on what they like. The habit of saving starts from a […]

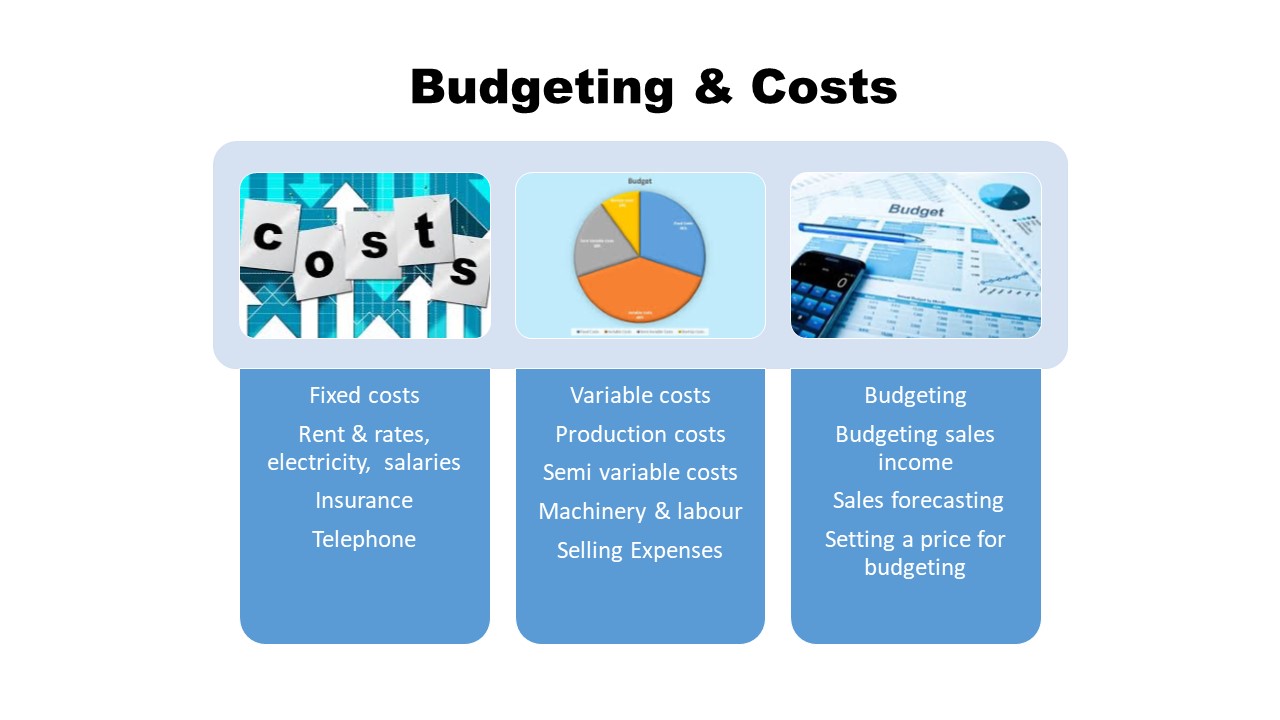

What is cost accounting used for? Cost accounting assists in calculating the manufacturing industry’s cost when producing goods for sale. Cost accounting is managerial accounting in the manufacturing industry, so the total prices include production, variable, and fixed costs. Cost accounting provides analysis & classification of expenditure. It helps to understand […]

What is the construction industry scheme? What is the construction industry scheme? A contractor will deduct money from a sub-contractor and pay that to HM Revenue and Customs. These deductions are the advance payment by the contractor towards the subcontractor’s tax and National insurance. Contractors have to register with the tax […]

What skills need to do accounting remotely? Currently, most companies allow workers to work from home; therefore, you must ensure you need the skills to perform the work from anywhere without making mistakes. Here are some tips for doing accounts remotely and successfully. Communication Any job, when done remotely, needs excellent […]