The Accounting Equation

Any entrepreneur running a business or anyone planning to start a company must learn about the accounting equation as it affects any significant business to small corner shops, especially when it comes to tax filing times. Therefore essential to know the basic concepts of financial reporting as an owner of a business. The economic data is processed, and the financial statements are prepared using the accounting equation. That is used to assess the company’s financial position in three items.

Any entrepreneur running a business or anyone planning to start a company must learn about the accounting equation as it affects any significant business to small corner shops, especially when it comes to tax filing times. Therefore essential to know the basic concepts of financial reporting as an owner of a business. The economic data is processed, and the financial statements are prepared using the accounting equation. That is used to assess the company’s financial position in three items.

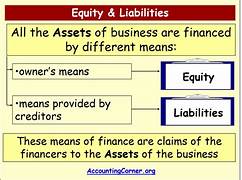

Assets ( what the company owns)

Liability ( the business owes to others)

Owner’s equity ( the difference between the assets and liabilities)

What is the equation?

The accounting equation explains how these three items are related to each other. The accounting equation in the case of the sole trader is as follows.

Assets = Liabilities + Owner’s Equity.

Assets

Assets are a company’s resources that benefit the company in the future; for example, assets are cash, accounts receivable, land buildings, equipment, inventory, investments, and prepaid insurance.

Liabilities

It is the amount of money that the company owes to others. For example, rent and rate, wages, accounts payable, tax payable, and interest on loans payable.

Owner’s equity

It is the amount invested in the business by the owner and the accumulated net income. The net income stays in business without making partner withdrawals, increasing the owner’s equity.

If the books are in order, the correct side balances will balance the left side without any issues. Any transactions will affect the accounting equation. For example, if the company gets a bank loan and increases the asset and the liability, the records must maintain accuracy. The left side of the equation shows what the company has and the excellent sideshow that the company has this money. So, the right side indicates whether the company borrowed the money or got the investments from the owners.

Assets paid all the liabilities.

When the assets pay all the obligations, then left with is the owner’s equity, all the resources belong to the owner. Then the accounting equation will be:

Assets-Liabilities= owner’s equity.

Balance sheet

The balance sheet is a financial statement representing the accounting equation. All the items in a balance sheet represent the accounting equation, but it is a vertical statement. The balance sheet shows the company’s financial position for a particular period. It is a significant financial statement as it is required by anyone to have business dealings with the company.

Small start-up business and its bookkeeping

Accounting equation for a start-up

Assets = Liabilities+ owner’s equity

$ 0 = $ 0 + $0

If the owner invests $2000 into the business, the change is there with the double-entry bookkeeping.

$2000 – $0 + $2000

Now the owner buys $200 worth of equipment; the accounting equation becomes as follows.

$2200 = $200 + $2000.

You can see that the equation balances because of double-entry bookkeeping. Therefore proper reporting is necessary, and if the comparison doesn’t restore, you will lose the reliability of your financial reports.