Importance of Cash Flow and Budgeting for your business.

Budgeting and Planning to Save

Learn the importance of cash flow and budgeting for your business

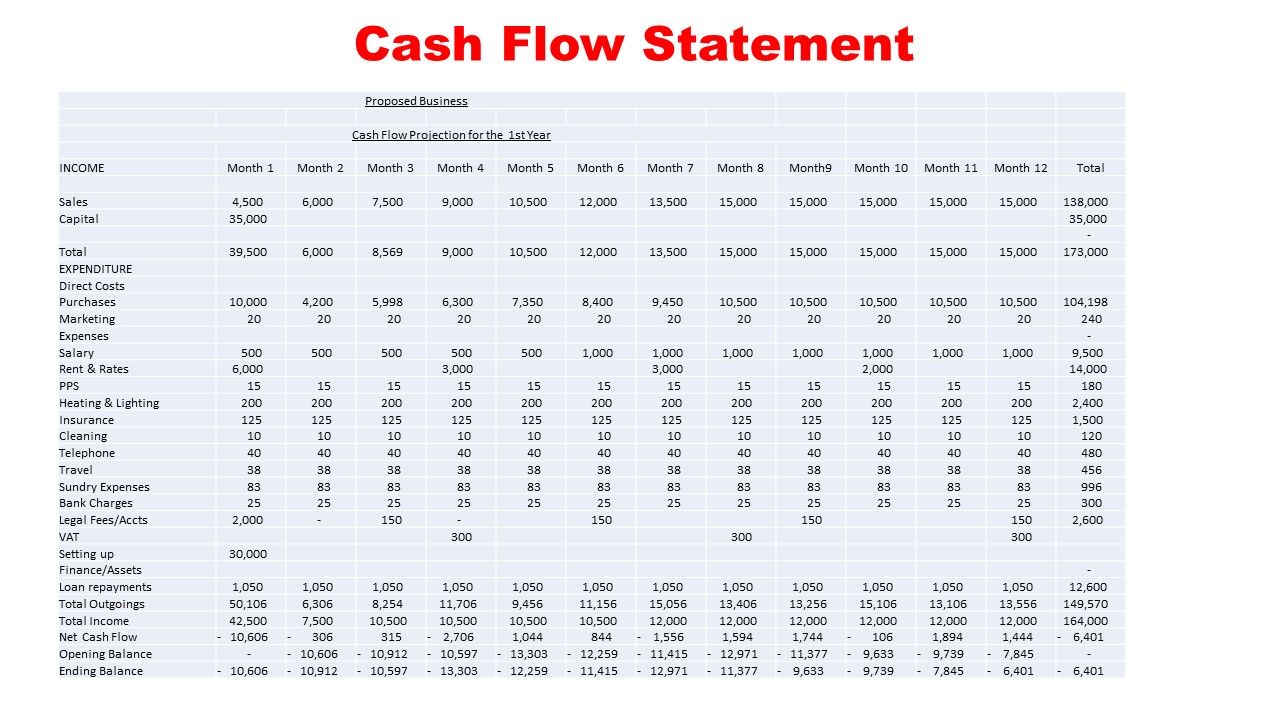

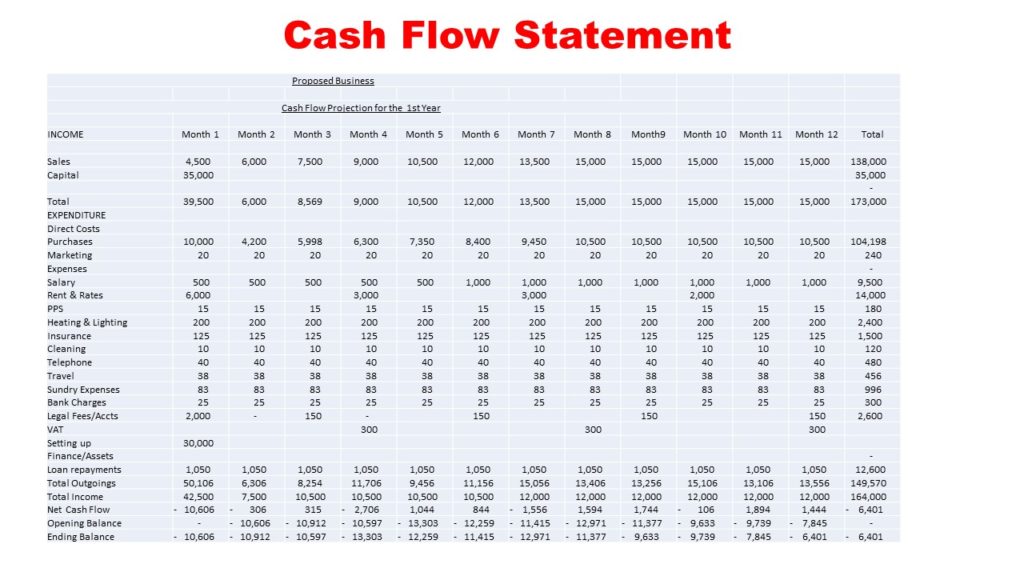

I thought I would let you know the importance of “Cash Flow” for the heat of your business. When they make enough sales, most small business owners think my business is doing well; there is nothing for me to worry about right now. However, unfortunately, they do not believe in their outgoings and the profit ratio. Cash comes into the business through sales, which is used to pay for various costs, and the difference between the two is the net cash. I cannot insist more and explain here the importance of maintaining cash flow for the survival of your business.

Keep learning.

You have set up the budget, and do not stop there. Keep investing in yourself and learn about money management. Please know how successful people manage their money; you will gain a lot. If you start to earn a lot of money, how will you manage your money? I know you will pay off all your debts and leave the remaining money in your bank account. By learning to control the money, you will also learn how to maximize your income. Then you need to redraft the budget to check how much money is left over and how to use it to make more money. By then, you will start to learn about investments.

Easy Steps to Create a Budget for Your Small Business

What’s the point of a budget?

A budget done correctly is the most accurate tool for analyzing and monitoring your finances imaginable. I am writing this article from my experience and helping others.

Why do I hate budgets?

I hated the figures when I had to create the budget for my business; I had some excuses. I always pretended that I didn’t have the time to do it. I was running my company for many years without a budget. When I looked at my bank records, I used to think I was alright because I had money. The time went on like that then I started putting some figures together for the budget. But I always missed the comparison of the actuals of income and expenditure against the budgeted number.

How does the budget help a business?

The budget sets your goal in the common term because they project the expected income and expenditure. When you put the budget almost accurately will be able to measure and decide whether you are reaching your goal. Another point is you will know your mistakes in the spending pattern. You have to take your income and expenditure totals and compare them with the projections. When you calculate the sums, you will know whether you have overspent or underspent. That is the biggest reason a budget is crucial for survival. Then if you want to apply for a loan, funding is needed. Any lender will not consider your application without knowing the company’s financial status.

Forecast for a quarter.

In this method, you must collect the figures for a quarter from the previous year’s accounts. I have got the reports done by professionals. Once you have taken the statistics, increase most numbers by a certain percentage according to the inflation. Then calculate the quarterly actuals and compare them with the budgeted amounts. Once you have prepared data, you need to do this task quarterly. It is the method I used, and I have explained it here.

What are the benefits of comparing the figures?

I have been comparing the figures monthly and finding out the area of over expenditure. That helped me to bring the finances under control on the expenditure side. Then I looked at my income and found out it had fallen; I started concentrating on both and nearly achieved my goal by the end of the year. I know my weakness of spending money on unnecessary things, which I could cut down.

Use of accounting software

Setting up accounting packages will be more comfortable and quicker if you are very busy with your business. I will mention two Quick Books and Sage line 50; both are easier to learn. Once you have uploaded the figures, printing out the necessary reports as and when needed is a matter of printing out the required information. The stories will be accurate unless you have made mistakes in initial uploads. Then you can continue using this package to extract other reports. It might be a tedious task initially, but hire a professional. But it is worth your money and time as producing reports required for your business is easy. As a result, you will be in complete control of your finances.

Use of Excel spreadsheet

Some entrepreneurs use Microsoft Excel to create budgets, cash flow projections, and other accounting work. It is cheap as you don’t have to spend any money to start doing the job. But have to be proficient in using the program to produce spreadsheets.

The spreadsheets will have all the necessary figures when you enter there. It is suitable for running a small business, but work will be tedious if you grow your business.

Use of the profit and loss account.

Financial statements are prepared at the end of the year to show the profit and loss of the company. The profit and loss account will also create projections for the following year.