Avoid mistakes to lose business profit

The firmness with receivables.

Most companies sell goods on credit to improve sales and get more customers. Then the company owner becomes happy, thinking the company is doing well but forgetting that the deals are only on credit. Remember, the company needs cash to top up the inventory, pay staff s, and other expenses related to the business. Therefore there is a possibility that the industry could face a cash flow problem.

Therefore, the best way to avoid that is to monitor cash flow regularly and be firm about receivables. Many small business owners become friendly with their customers and do not have control over the payments. Even though you want to be valuable to your clients but consider that you run a business; if you do not have the firmness, you will fall into debt. Therefore, introduce the credit-control system and follow it up carefully so your customer will not miss the payments within the deadline.

Pay yourself first

Most entrepreneurs ignore that they should pay to avoid financial struggles in their personal life. Moreover, it might also lead to using their credit card for your business. It would be best if you had separate rules to pay yourself regularly at a necessary amount. The second vital issue is to make sure you put aside money monthly for emergency and retirement funds.

Tax Laws Are Your Friend

Most entrepreneurs get upset when you talk to them about tax payments without realizing g that they can claim their business expenses. In other words, tax laws teach you how to monitor your hard-earned profits. Unbelievably, tax laws at the state and federal levels are designed to help small businesses succeed during the difficult initial years. Educate yourself on what you can write off in your state, and track all your expenses. You already know legitimate business expenses—including rent, payroll, and equipment—are deductible. Also, remember that you can reduce your tax burden by writing off business losses.

Avoid mistakes to lose profit.

Know What You Can and Can’t Do Yourself

If you are a busy entrepreneur, keeping the books should not be a full-time job. Be realistic about how much you can do independently without dividing your responsibilities. Do not be afraid to turn to a professional for help. Bringing on a bookkeeper in a freelance or part-time capacity can ensure you continue handling your money as effectively as possible.

Whether you choose to hire outside help or not, there are cloud-based solutions that can make managing your essential files seamless and straightforward. Document management software like eFileCabinet can be a handy ally for any business owner. Who feels stretched a little too thin when taking care of the paperwork?

Avoid mistakes to lose profit.

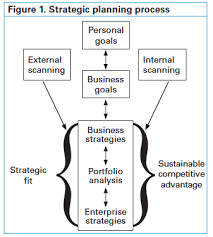

When your business grows, your needs change. Your financial processes are some of the essential functions of your organization. You may think it’s safer to maintain the status quo, but your company can benefit from considering new opportunities when it comes to accounting. See why you may want to use a different strategy to enhance your business.