Final Accounts of a sole trader Part 1

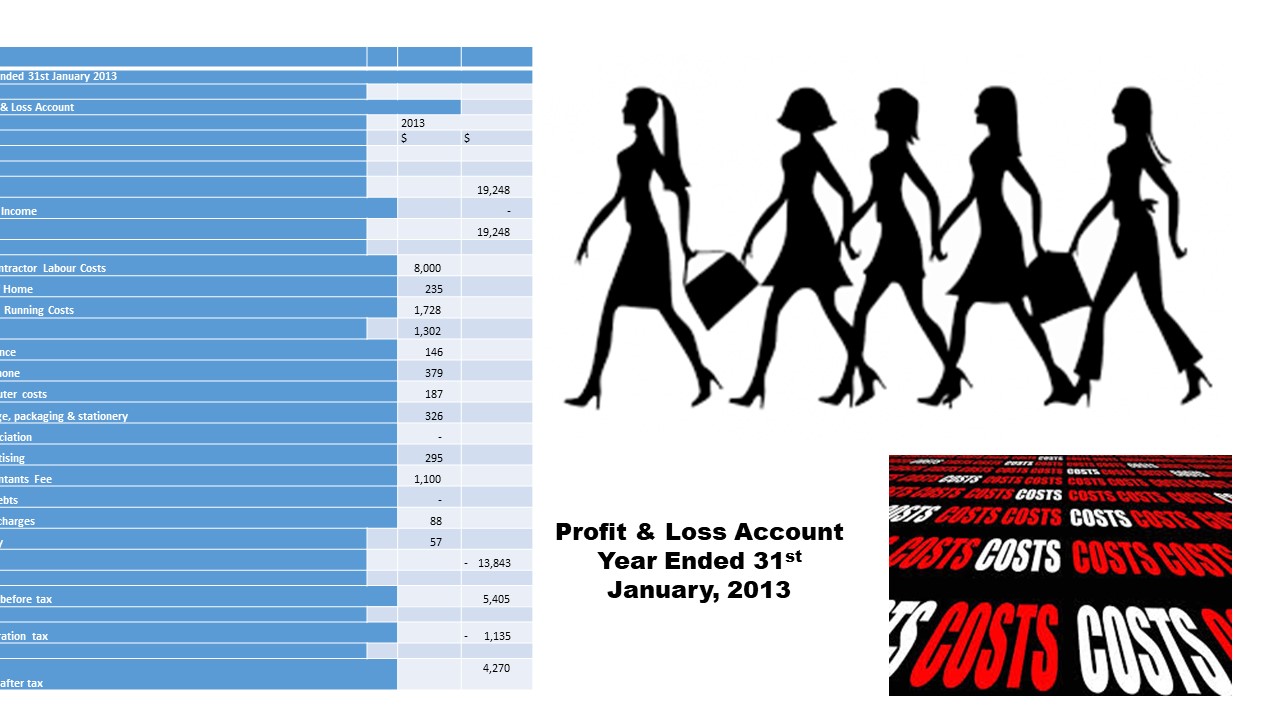

Final reports include a profit and loss account and a balance sheet. Profit and loss show whether the company has achieved profit or loss. A financial statement summarises the costs, expenses, and revenues during a specified period. These records help the company increase profit by reducing costs and the need to increase sales.

Profit and loss accounts show your total income and expenses and confirm whether your business has earned more revenue than it has spent on running costs. If that is the case, then your company has made a profit.

A profit and loss account for a sole trader business:

| Trading and Profit and Loss account | |

| for the year ended 31 August | |

| Turnover | 21089 |

| Less Returns inwards | -652 |

| 20437 | |

| Cost of sales | |

| Opening stock | 2000 |

| Purchases | 6525 |

| Less Returns outwards | -720 |

| 5805 | |

| Add Transport charges | 150 |

| Wages for warehouse | 2892 |

| 10847 | |

| Less Closing stock | -2645 |

| -8202 | |

| Gross profit | 12235 |

| Other income | 690 |

| 12925 | |

| Salaries | 4865 |

| Rates | 450 |

| Advertising | 264 |

| Carriage outwards | 160 |

| General expenses | 658 |

| -6397 | |

| Net profit | 6528 |

Purchases showed fewer returns to arrive at the net figure of £5805, and the cost of transporting the goods was added as it increased the trading expense. Warehouse costs are considered part of the cost of sales. Also, not always all the stocks will be sold; therefore, it is deducted to arrive at the actual price of the sales figure.https://amzn.to/2W28Ik3

Final Accounts of a sole trader Part 1

The credit side of the profit and loss of accounts shows the amount of credit and cash sales than the value of the goods returned to arrive at the actual sales figure. Therefore, the difference between actual net sales and the cost of sales is the business’s gross profit.

The debit side of the profit and loss account is expenses from the cashbook, such as carriage outwards, a fee on selling, and distributions of goods.

Salaries generally expenses refer to the monthly salary paid to staff. When compared to the wages paid to warehouse and production staff, they are primarily a static figure — any other fees paid to clean are charged to the profit and loss account.

Profit and loss accounts are used to calculate the profit earned during a specified period, and from there, the tax liabilities are calculated for a specified period. Failing to file returns and pay the corporation, you become liable to interest and penalties.

It shows lenders, investors, and other interested parties how much your company has earned during a specific period. If you cannot produce a financial statement like this, the lenders will not approve the loans if you have applied for your business.

https://www.sataccounts.co.uk/2019/05/07/bookkeeping-essentials-introduction/ https://tinyurl.com/y3c79mpr