How to implement financial control in business?

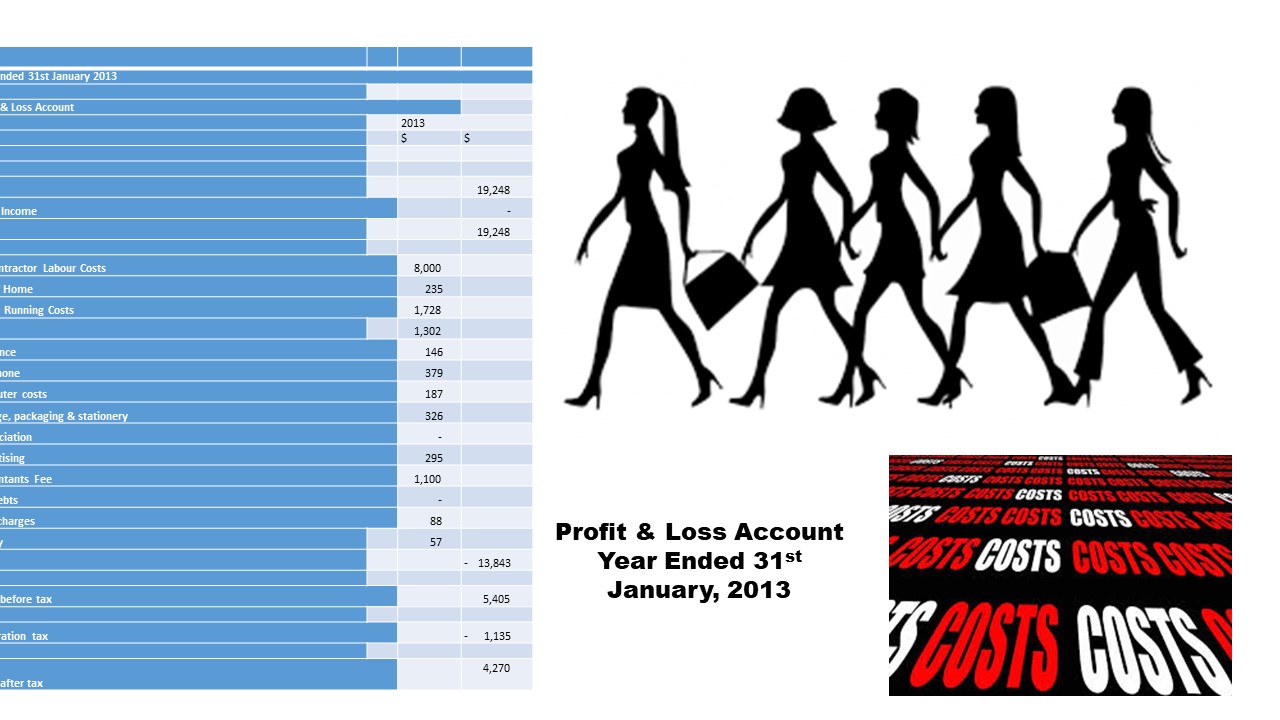

Profit & Loss forecast

The profit and loss forecast is a projection of the sales and expenses that might occur during a specified period. If you say in a pure form, that is the forecast for the money you receive and your payout, which most businesses heavily rely upon when managing their business.

How to implement financial control in business?

The details of the forecast depend on the size of your business. Even the smallest business needs this detail, and depending on mental calculations is undesirable for the company.

A clear idea of the amount of working capital from the profit and loss forecast helps you decide about your business’s growth. If the forecast shows that cash is available, investing in items applicable to your business development will be advisable.

When you have done your profit and loss forecast, follow the contents in the document you prepared and take quick actions to help reduce business risks. On the other hand, it is also helpful to develop your business by increasing sales, the productivity of the bestselling items, and encouraging more repeat sales.

Cash flow forecast

Cash flow can suppress your business. If you do not know how much cash is going out and coming in, there is no control over the money in your industry. Ultimately, it can kill your business. Most businesses fail due to cash flow problems; customers do not pay on time, and you overspend on unnecessary things.

There are a few things you need to check when you manage your business as it will affect your cash flow:

- You need to check your cash flow statement regularly.

- Receive payments from customers by the deadline for payments.

- Stop ordering stocks not required for immediate sales.

- Cut down the overtime for staff.

- Try and make the sales on cash

- Reduce credit sales.

Benefits of having a profit and loss forecast

- You will find it easy to assess your tax obligations.

- Useful to obtain loans or grants

- Credit agreements from potential suppliers.

- You need to invest in another business or expand your business.

A profit and loss forecast includes estimated turnover, direct and indirect costs.

Business plan

Then it is also essential to have a business plan and all these documents because that requires a business loan, grant applications, and any investors to learn about your business. A business plan document is used for reference when you have trouble in your business because it details all the possible precautions. A business plan includes all about your business, marketing plan, financial, and operating procedure.

These documents are vital for any business to avoid the pitfalls and prepare yourself to meet the setbacks in your industry. A delay happens to any company at any time.

Therefore, when you think about enforcing financial control, first prepare a cash flow forecast, profit and loss forecast, and business plan. However, remember to revise those documents regularly. If not, it becomes outdated as the business grows or is about to sink. Then you will be able to safeguard your business from problems.