How to expand your records as your business grows? Analyzed cash book You might want to know some management information regarding your expenses as your business grows. As income increases, the costs also will increase. Therefore, it is vital to know about your expenditure. For example, you might want to know […]

Is your business outgrown accounting expertise? Your Employees Have Too Much on Their Plate If your employees have been multitasking to stay on top of bookkeeping jobs, outsourcing can eliminate distractions and let them return to their duties. Besides, the combination of outsourcing and an online accounting service provides access to […]

How do you construct cash flow? The cash flow statement provides valuable information about the company, such as gross income, payments, and insight into future revenue. A cash flow statement has three sections for operating, investment, and financial activities. Most businesses prefer a direct method to prepare a cash flow statement […]

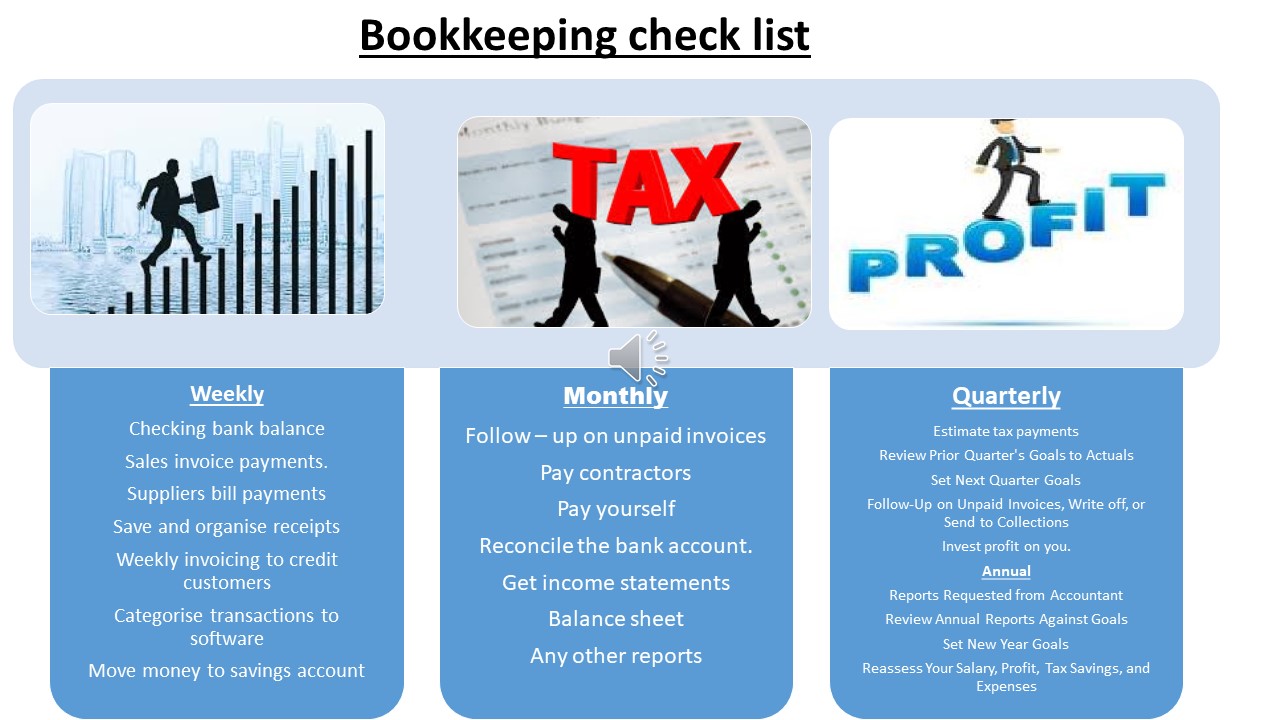

Organize a suitable accounting structure for your business. How you operate your business and accounting for all the business transactions will give you satisfaction in running a business; if not will make you feel empty when you don’t know the results of your business achievements. The results mean the month-end accounting […]

Credit transactions and suppliers’ accounts What is a credit transaction? When you sell your goods, allow your customer to pay later according to your credit agreement. https://tinyurl.com/yyt6sqb4 Suppliers account Maintain records for the goods sold to your customers to avoid missed payments or exceeding the credit agreement periods. All this time, […]

Classification of accounts Reasons for classifying the accounts. People think that accounting for a small business is easy, that is, to calculate the income, deduct the total expenses, the leftover id s, your profit, and your asset. That is not the proper way to account, and you need to give detailed […]

I am creating an online course called “Bookkeeping Essentials” and planning to launch it soon. It is helpful for students and entrepreneurs to help to maintain their books. A proper accounting system is vital for a small business or a corporation. Keeping your accounting records in order helps avoid mistakes and […]

Bookkeeping Today for small business owners. The reason for me to write about bookkeeping today is to show small business owners the reliability of accounting packages. It might look expensive initially, but it helps an entrepreneur massively in the long term. You will know the financial viability of your business. Another […]

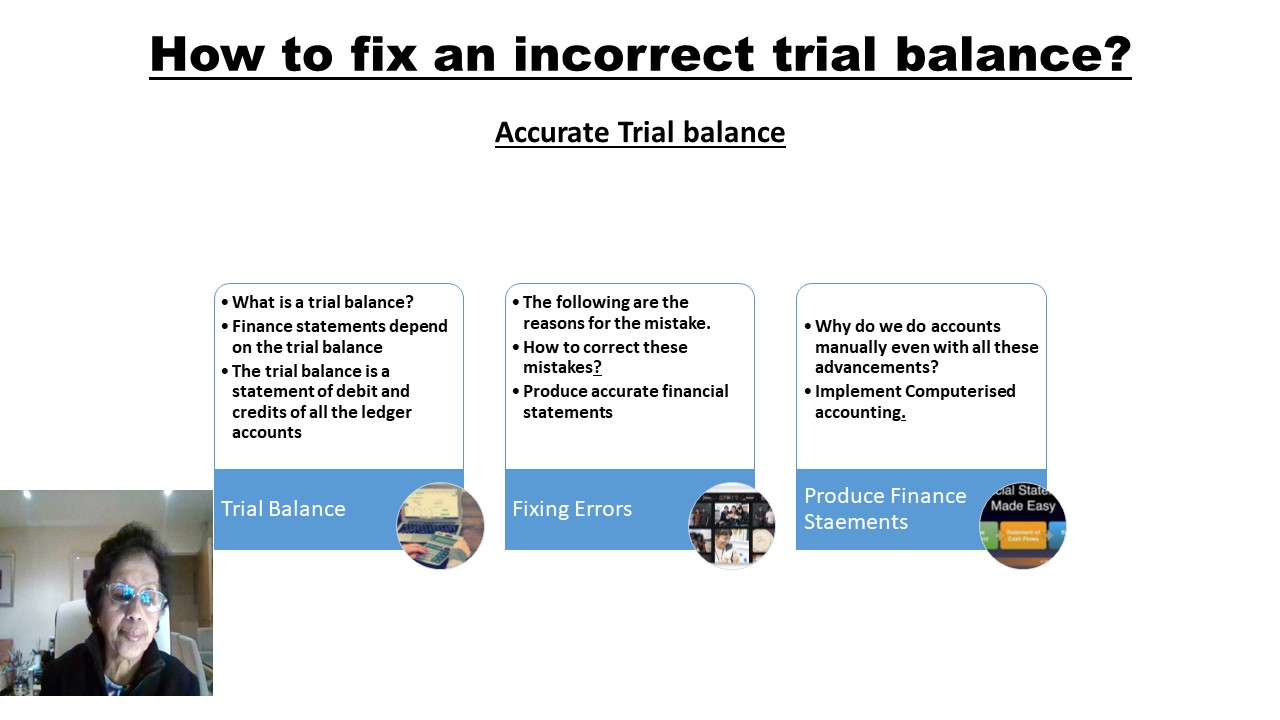

Important financial documents for a small business As a small business owner, you need to prepare these documents to ascertain the economic status of your company. In addition, it becomes proof to show your company’s financial condition and to make wiser divisions for the future. Trail balance construction. A trial balance has to balance; if […]

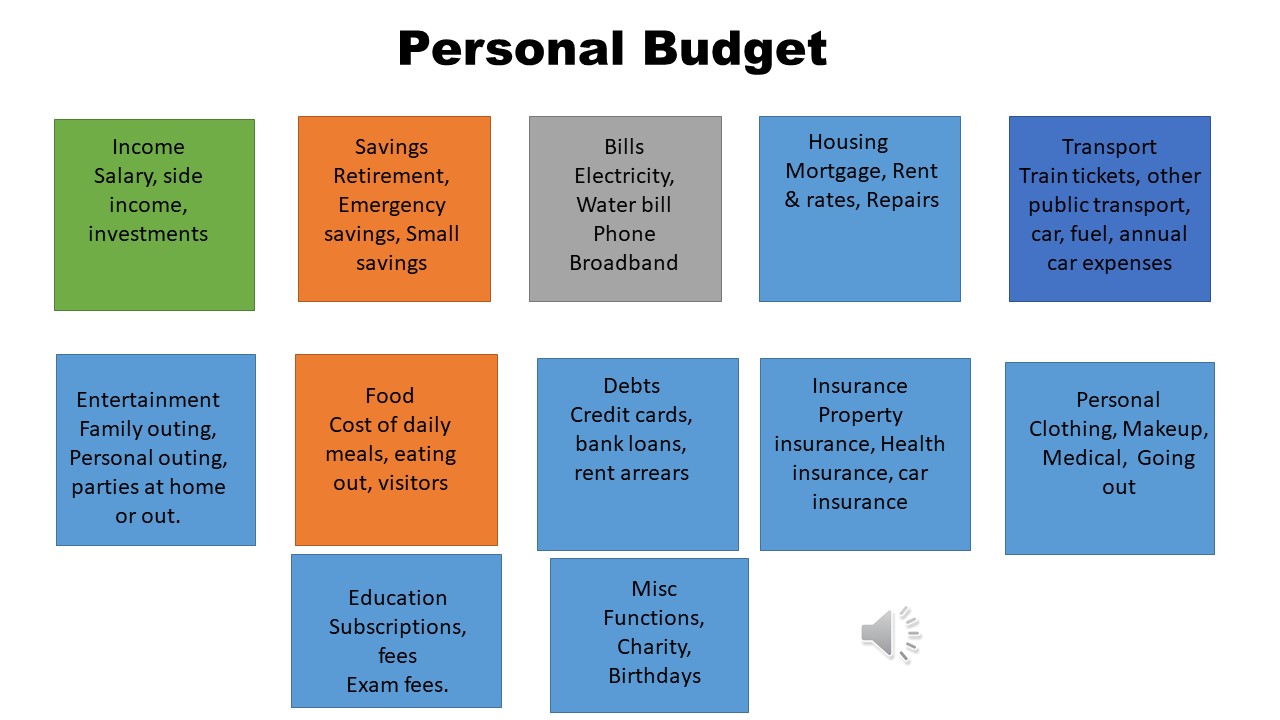

How To Budget When You’re Penniless? The trouble is maintaining a budget when you have an awful time with finances. At this stage, you must have mounting bills and no funds to meet those bills. Take immediate action Do not ever become heartbroken and ignore anything. Contact the creditors immediately and […]