Credit transactions and suppliers’ accounts

What is a credit transaction?

When you sell your goods, allow your customer to pay later according to your credit agreement.

Suppliers account

Maintain records for the goods sold to your customers to avoid missed payments or exceeding the credit agreement periods.

All this time, I have been talking about cash transactions which mean payments made to the supplier as and when a product is acquired. Nevertheless, modern-day business operates its business mostly on credit terms. When a purchase is made on credit, the company gets a credit agreement for payment may be a week, two weeks, or even a month. Therefore, a correct record must be maintained to avoid duplicate charges or missed fees that may affect your credit history. A creditor is someone who has supplied your product or service on credit, so money is owed to the creditor.

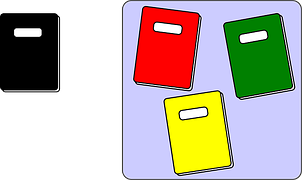

When a purchase is made on credit, the amount is posted into an account called accounts payable, a short-term debt. A company must pay another enterprise for the product or services acquired during its operations. Here the ledger system starts to change as you may have many suppliers; in that case, you need to have individual ledger accounts to show them the amount payable to them to avoid disputes. When you receive an invoice from a supplier, you must make the necessary entries. Then when you pay that supplier, appropriate entries must be made to close that supplier’s account.

Therefore, the two large accounts are maintained; one is the purchase ledger, and the other is the sales ledger. The total of the purchase ledger is posted to the purchase account, and the whole sales ledger is assigned to the sales account. Daybooks are kept for audit purposes entering all the purchases and the sales in the purchase daybook and sales day text, respectively. The exclusive shopping and sales invoice is registered for checks in case of account issues.

Purchase daybook

When a purchaser receives an invoice from the vendor, all the necessary information is entered in the purchase daybook. The details in the invoice, such as date, name of the supplier, quantity, ledger folio number, and the amount. All the entries in the purchase daybook totals are posted to the debit of the book and credited to the name of the supplier’s account.

If value-added tax is applicable, a different column is needed in the purchase day book. Therefore the above entries are made in the books to maintain the credit transactions to avoid errors such as duplicate payments, overpayments, and missing payments.