Classification of accounts

Reasons for classifying the accounts.

People think that accounting for a small business is easy, that is, to calculate the income, deduct the total expenses, the leftover id s, your profit, and your asset. That is not the proper way to account, and you need to give detailed information to investors, bankers, and your customers to rely on your services or products. Therefore the classification of accounts has to come into effect to produce detailed information about your business. That leads you to create different kinds of statements, such as debts, revenue, and assets, to give more details about your company to lenders, investors, and the public.

Business transactions are entered into accounts and classified into five types of accounts.

- Assets

- Liability

- Revenue

- Expenses account

- Equity account.

Accounting Categories and Their role

Asset Account

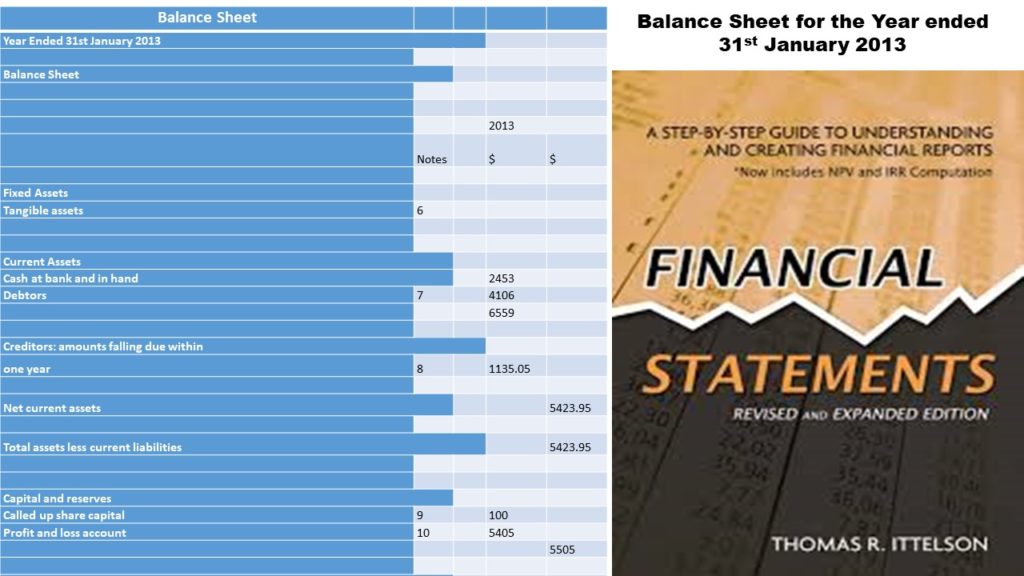

It is an account where all the assets of the companies, such as land & building, machinery equipment, cash, inventories, and debtors, are kept and monitored. Various accounting rules are applied to assets and grouped separately, such as the following, which are included in the balance sheet.

Cash includes cash in the bank account, deposit, and petty cash

Inventory; Stocks: finished goods, work –in progress, raw materials

Accounts receivable\; Trade receivables, prepayments, and receivables due from employees.

Fixed assets refer to Land and buildings, machinery, vehicles, computer, and software.

The intangible assets could be goodwill, copyright, or patent rights. Each account is maintained separately to see the increase and decrease in the reports. Then the broader classification of the assets is short and long-term assets. Short-term assets used in one financial year are Debtors’ control accounts, accounts receivable, and cash in the bank. Long-term period assets are land and buildings, machinery, and vehicles.

The concept of asset classification applied to the investments held by the entity as follows:

- Bonds

- Real estate

- Cash holdings,

- Equity

Liability account

It refers to the company’s liability in a specified period, whether long-term or short-term. The debts could be a mortgage, loans from lenders, and accruals within an accounting period that includes accounts payable such as wages, rent, and other bills payable. Besides, income earned in advance also classifies accrued income as the services not provided within that period and taken to the balance sheet as the liability. Visit https://tinyurl.com/y2hx8lg4 to learn how to set up a business.

Revenue

It refers to the income received during a stipulated accounting period and items like your business’s prepayments and accounts receivable. Accounts receivable, when taken to the balance sheet as a short-term asset, means goods have been delivered, or services but payments have not been received. If a company invests in another company, the income received is classified as dividend income.

Expenses account

All the costs incurred for daily production operation refers to salary, marketing, and all the purchases for the business. Expenses incurred during a financial period but not paid by the company will include in the financial statements as accounts payable

The following are the common types of costs mentioned in the financial statements

• Salaries and wages

• Utility expenses

• Cost of goods sold

• Administration expenses

• Finance costs

• Depreciation

• Impairment losses

Equity account

Equity means the owner’s interest in the business, referred to as assets minus liabilities. The balance in the capital increases when more money is introduced and the company makes a profit. Whereas the amount in the capital account decreases when withdrawals are made and if the company makes a loss. In the case of a small business, a single capital account is set up, known as the owner’s capital account. In a sole proprietorship, when the owner takes cash or assets, it is classified as the drawings and decreases the capital account.

| Charity Accounting check list https://tinyurl.com/y7cs98z9 |